How Did the Tax Brackets Change. But a win by Democrat presidential candidate Joe Biden in November will change these brackets.

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Federal Tax Cuts In The Bush Obama And Trump Years Itep

2020 Tax Brackets for SingleMarried Filing JointlyTax RateTaxable Income SingleTaxable Income Married Filing Jointly10Up to 9875Up to 19750129876 to 4012519751 to 802502240126 to 8552580251 to 1710502485526 to 163300171051 to 326600.

Trump tax brackets. Each year the taxman updates its individual income tax brackets to reflect inflation. There are seven brackets. The Tax Cuts and Jobs Act came into force when President Trump signed it.

The brackets proposed are 10 12 22 24 32 35 and 385. Under the new Trump tax brackets he wont be in the new top rate of 37 unless his taxable income is more than 500000. 10 12 22 24 32 35 and 37.

For 2018 2019 and beyond their highest tax rate is just 24. Tax brackets under the new plan would. A fairer benchmark is what would happen to taxes while the Trump cuts are still in place.

Other changes include cutting the rates of income tax doubling standard deductions but also cutting some personal exemptions. From there we would see a progressive increase in ordinary income tax rates to 10 20 and the highest marginal tax bracket of 25. The highest tax bracket is now 37 for big earners.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. These taxpayers are subject to a 37 rate on incomes over these thresholds after exemptions and deductions. A married couple whose total income minus deductions is 250000 for instance would have had a tax rate of up to 33 in 2017.

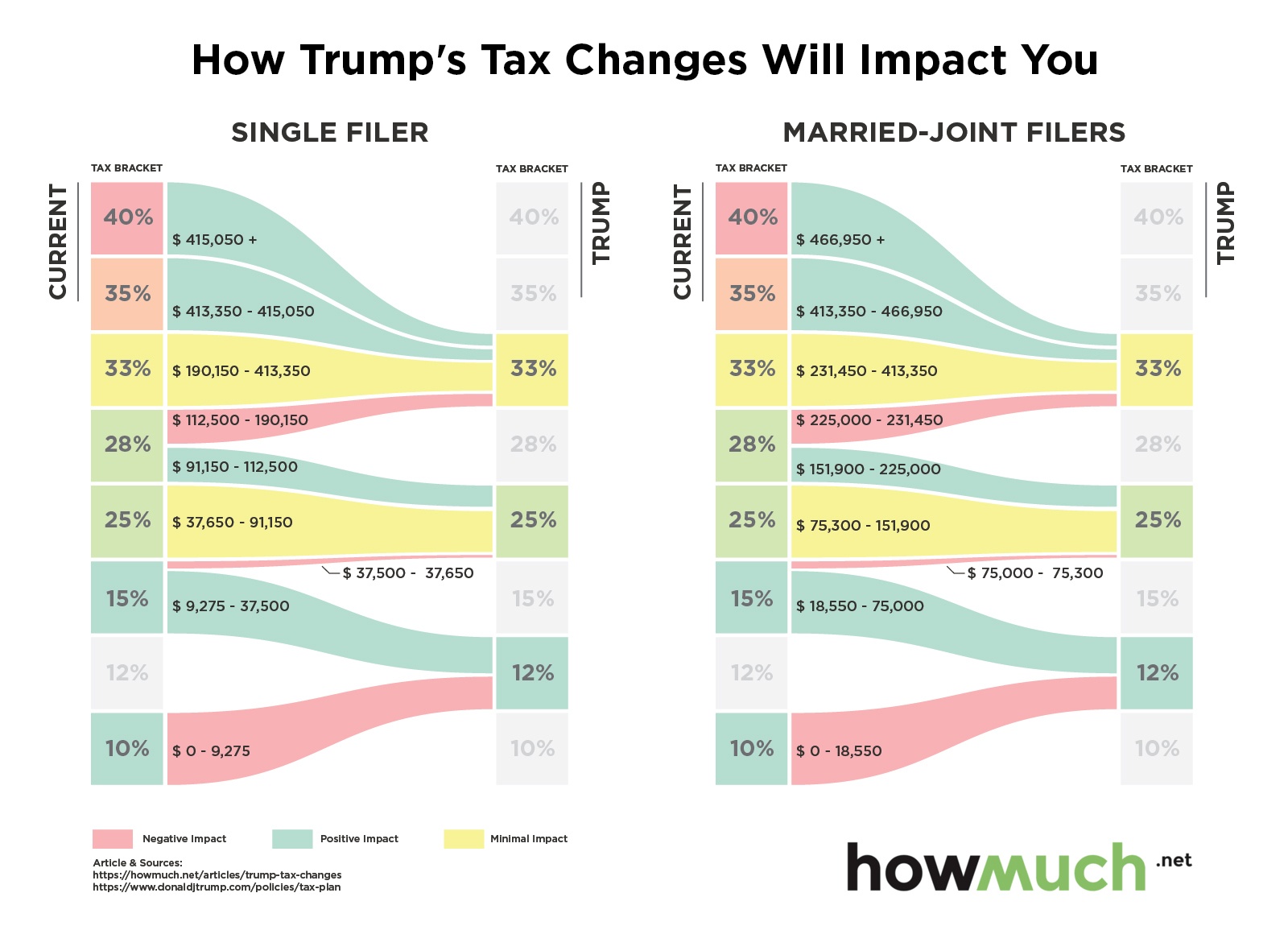

Thats still a lot but. The highest tax bracket starts at just over 510000 in taxable income for single people and 610000 for married couples as of 2019. The biggest changes under the new Trump tax plan came for those in the middle of the chart.

The tax law passed by Republicans without any Democratic support lowered the corporate rate from 35 percent to 21 percent and cut individual taxes across income brackets for eight years. Federal Income Tax Bracket for 2020 filed in April 2021. This was a major overhaul of the tax system and established the following tax brackets.

10 12 22 24 32 35 and 37. The brackets proposed are 10 12 22 24 32 35 and 385. American taxpayers have been categorized into one of seven brackets depending on income.

The plan laid out by Senate Republicans keeps seven tax brackets but tweaks the rates and the income ranges associated with each. The TCJA still provides for seven brackets but theyve been reduced somewhat. President Donald Trumps tax plan proposes simplifying the seven tax brackets we have now down to four.

Trump tax brackets What is the current tax bracket for 2020. It lowered the corporate tax rate to 21 from 35 at the turn of 2018. Each bracket accommodates more income.

One of the major victories for the Trump administration over the past four years is the tax plan that passed Congress and was signed by the President in 2017. Trump and his advisers a year ago floated the idea of a 15 income tax rate for middle-income Americans down from the current 22 for individuals making up to 85000 a year. There are still seven federal income tax brackets but at slightly lower rates and adjusted income ranges.

The Senates version would keep seven brackets but at slightly lower rates and adjusted income ranges. 3 That didnt happen. In 2025 according to the Tax Policy Center the top 1 would get 25 of the cut.

The Effect of Tax Brackets President Trump initially proposed to lower income taxes and reduce the number of tax brackets from seven to three12 25 and 35.