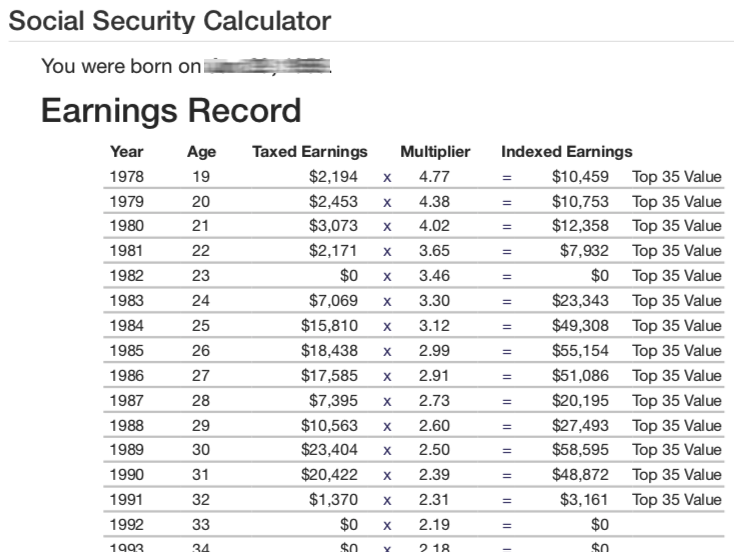

What Is the Maximum Spousal Social Security Benefit. If your spouse is not yet receiving retirement benefits you can claim your own Social Security starting at 62 and later switch to spousal benefits when your spouse files.

The 2020 Guide To Social Security Spousal Benefits Simplywise

The 2020 Guide To Social Security Spousal Benefits Simplywise

Your spousal benefit is not affected by the age at which your husband or wife claimed Social Security benefits.

Claiming spousal benefit social security. If you dont have an account you can. With survivor benefits if your late spouse boosted his or her Social Security payment by waiting past FRA to file your survivor benefit would also increase. 2 1954 then when you claim benefits you are subject to deemed filing.

Her ex-husbands benefit at FRA is 2400 meaning she is eligible for a 1200 spousal benefit. The spousal benefit amount tops up the claiming spouses own benefit. For example an ex-wifes Social Security benefit is 1000 a month.

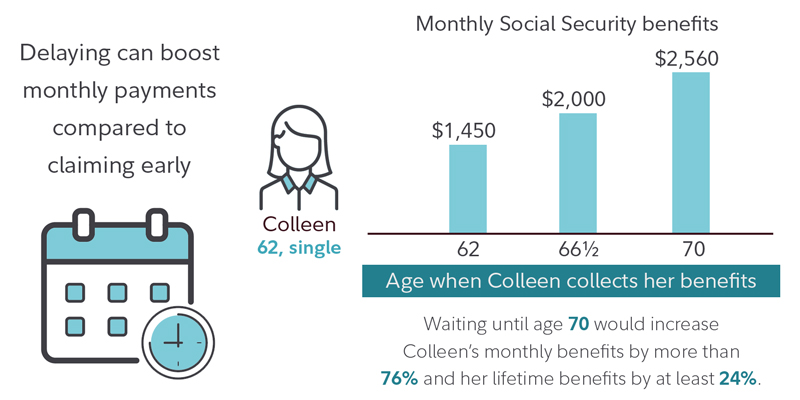

If the spouse begins receiving benefits before normal or full retirement age the spouse will receive a reduced benefit. When you apply for your retirement benefit youre also automatically deemed to be. If the spouse kept working after full retirement age 66 to 70 and delayed taking SS benefit to 70 so his delayed benefit at 70 is higher than that of full retirement age from additional SS.

The spousal benefit amount tops up the claiming spouses own benefit. She gets whats called an auxiliary or. If your benefits as a spouse are higher than your own retirement benefits you will get a combination of benefits equaling the higher spouse benefit.

The maximum spousal benefit is 50 of the amount that the spouse is eligible to receive at full retirement age. Under this provision you dont have a choice whether to wait and switch. It will always be based on your mates primary insurance amount.

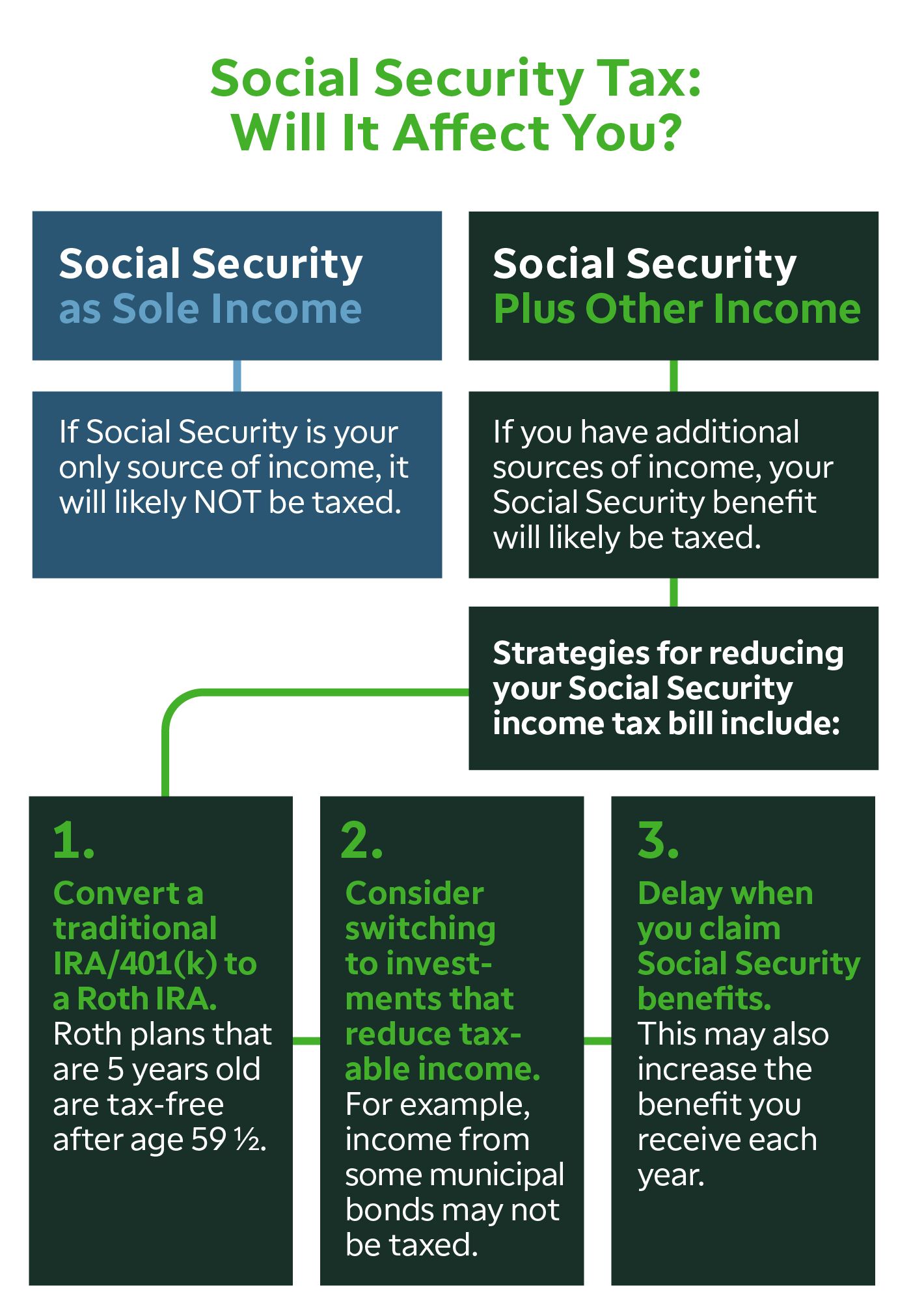

You are eligible for spousal benefits if your spouse has filed for Social Security benefits and you are at least age 62 or caring for a child whos entitled to receive benefits on your spouses. Social Security will not pay the sum of your retirement and spousal benefits. You can claim a Social Security benefit based on your own earnings record or you can collect a spousal benefit that will provide you 50 percent of the amount of your spouses Social Security benefit as calculated at their full retirement age or FRA.

If your spouse is already getting Social Security when you claim benefits you are subject to the deemed filing rule. Thats a cap by the way. If you do have enough credits to qualify for your own Social Security benefits and you apply for your own retirement benefits and for benefits as a spouse we always pay your own benefits first.

However if your spouse is already collecting Social Security and if you were born on or after Jan. It seems that a spousal benefit can be as much as half of the higher-earning spouses Social Security benefit at their full retirement age. You should be married for at least one year before applying for Social Security benefits.

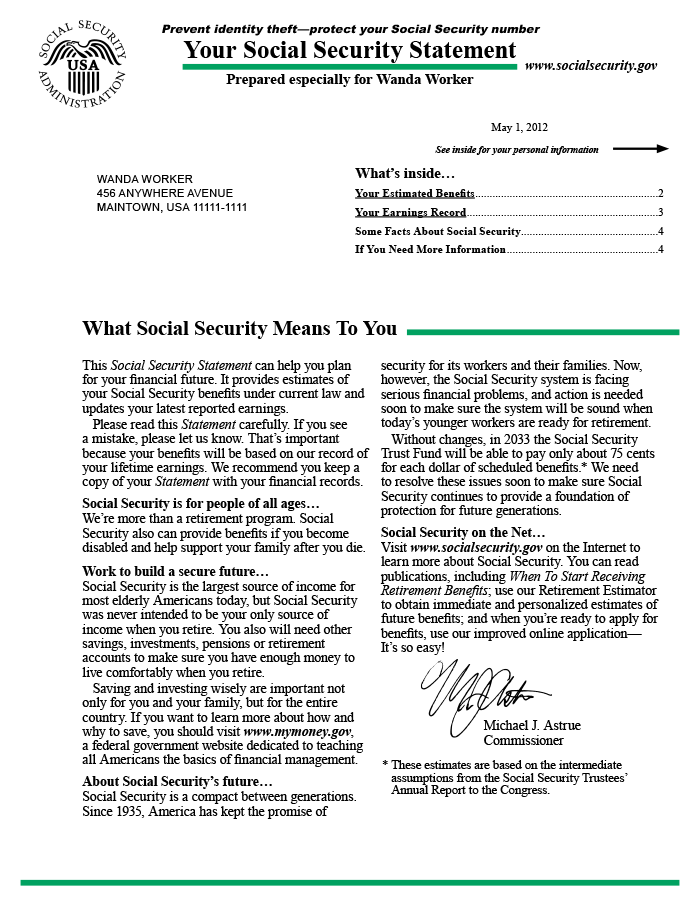

Her ex-husbands benefit at FRA is. You are eligible for spousal benefits if your spouse has filed for Social Security benefits. The easiest way to apply for spousal Social Security benefits is through your My Social Security account at httpswwwssagovmyaccount.

Youll get a payment equal to the higher of the two benefits. The spousal benefit can be as much as half of the workers primary insurance amount depending on the spouses age at retirement. For example an ex-wifes Social Security benefit is 1000 a month.

If you file before full retirement age you are automatically deemed applying for spousal benefits as well as long as your husband or wife already is receiving Social Security. Spousal benefits from Social Security When a worker files for benefits from Social Security the workers spouse may be able to claim a benefit based. However if a spouse is caring for a qualifying child the spousal benefit is not reduced.