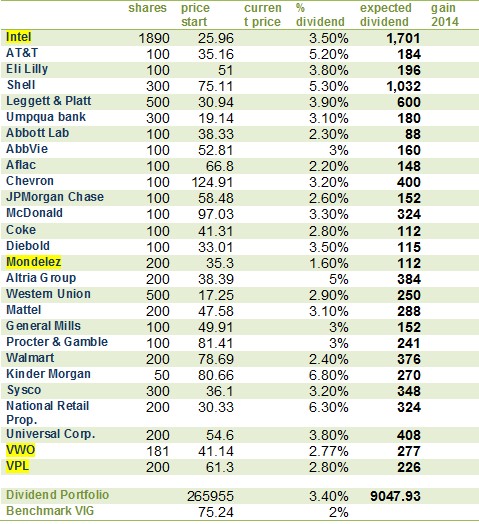

I oversee our Conservative Retirees dividend portfolio which is designed for people living off dividends in retirement. Of this 30000 is spent on essential expenses.

How To Build A Dividend Portfolio Intelligent Income By Simply Safe Dividends

How To Build A Dividend Portfolio Intelligent Income By Simply Safe Dividends

Dividend growth is expected to be moderately and the portfolio should keep up with the broader market over time.

Dividend retirement portfolio. Dividends can be used to hedge against volatility and inflation by providing a steady delivery of income. A properly constructed basket of dividend stocks can provide safe current income income growth and long-term capital appreciation to help investors stay the course and make a retirement portfolio last a lifetime. A fully paid-for retirement on just a 437500 nest egg.

Be it a. On the downside companies can choose not to declare dividends which can negate the. The benchmark for this portfolio Invescos High Dividend Low Volatility ETF SPHD also gained a lot and added 953.

However you should aim to make a portfolio of dividend stocks that gives you a conservative dividend yield of 5. The starting year the portfolio produces 50000 in dividend income. Quality dividend stocks can serve as a foundational component of current income and total return for a retirement portfolio.

Investors should choose companies that can continue to pay dividends in the future. And once individuals need to live off their portfolio the dividends provide a source of income without having to tap their principal. Dividend yield is an easy data point to access but dividend growth is not easy and assessing the dividend safety of a stock is another story.

Dividend stocks remain one of the core elements of a retirement portfolio. Your Retirement Portfolio Must Keep Up with Inflation To start with a dividend yield above inflation is not how you keep up with inflation thats a misleading thought. The First Bet 30 of the Portfolio.

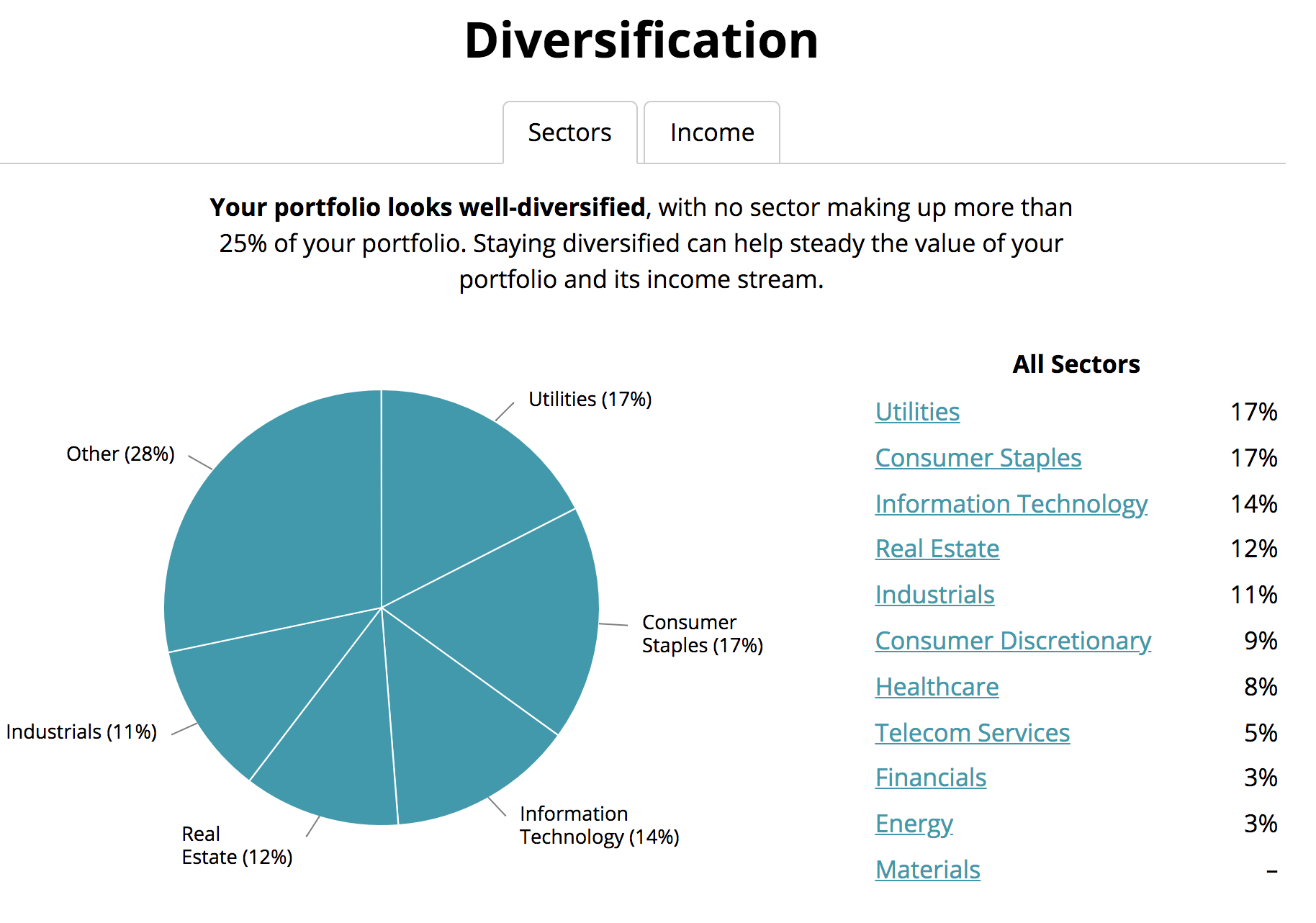

Safe dividends income growth in excess of the rate of inflation and low volatility are some of the main goals of any retirement portfolio. Dividend Retirement Portfolio up 850 in March Our retirement portfolio jumped 850 in March 2021 which is above the SP 500 index which rose 438 this month. Many of us are managing dividend portfolios designed to deliver safe retirement income.

Equity portfolios come with risks involving non-guaranteed dividends and economic risks. Save up that much and you can look forward to a steady 35000 in dividends which is. The two main objectives of our new Retirement Dividend Portfolio is to preserve capital and deliver a safe dividend yield above the markets average.

As individuals near retirement the ability to reinvest dividends allows for a greater total return. So suppose your portfolio is 1 mil. Finally although the focus of this new portfolio is primarily income the following four stocks offer a bit more growth potential to go along with their dividends.

For a high-yielding dividend portfolio Milan uses a closed-end mutual fund Eaton Vance Tax-Managed Dividend Equity Income ETY which uses a. Against this backdrop below we highlight a few ETF strategies that could be considered in a retirement portfolio with a long-term focus. Rules for the Dividend Retirement portfolio Follow my general method for buying and selling dividend growth stocks although I will allocate a small portion to more aggressive dividend growth stocks.

If the latter happens the 50000-income stream would grow to. The Vanguard Dividend Appreciation ETF VIG and the WisdomTree US. Quality Dividend Growth Fund.

Selectively reinvest dividends into existing positions or new positions that meet the criteria set in.