Top Dividend Stocks for April 2021 ETRN GLPI BDN PPL and NYCB are top by forward dividend yield. Coba strategi Anda dengan perdagangan kecil mulai dari 1.

The Top Monthly Pay Dividend Stocks And Funds For August Seeking Alpha

The Top Monthly Pay Dividend Stocks And Funds For August Seeking Alpha

Ad Buat prediksi dan lihat hasilnya dalam 1 menit.

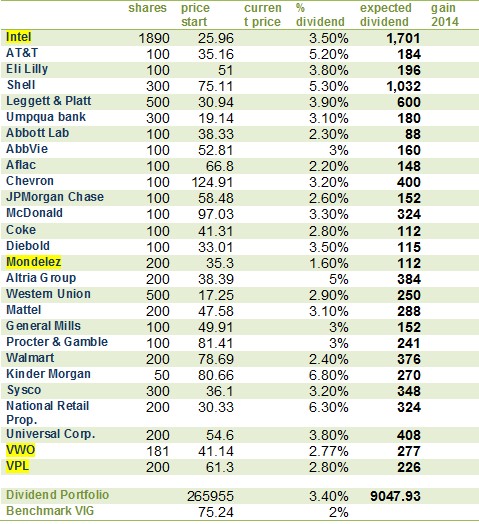

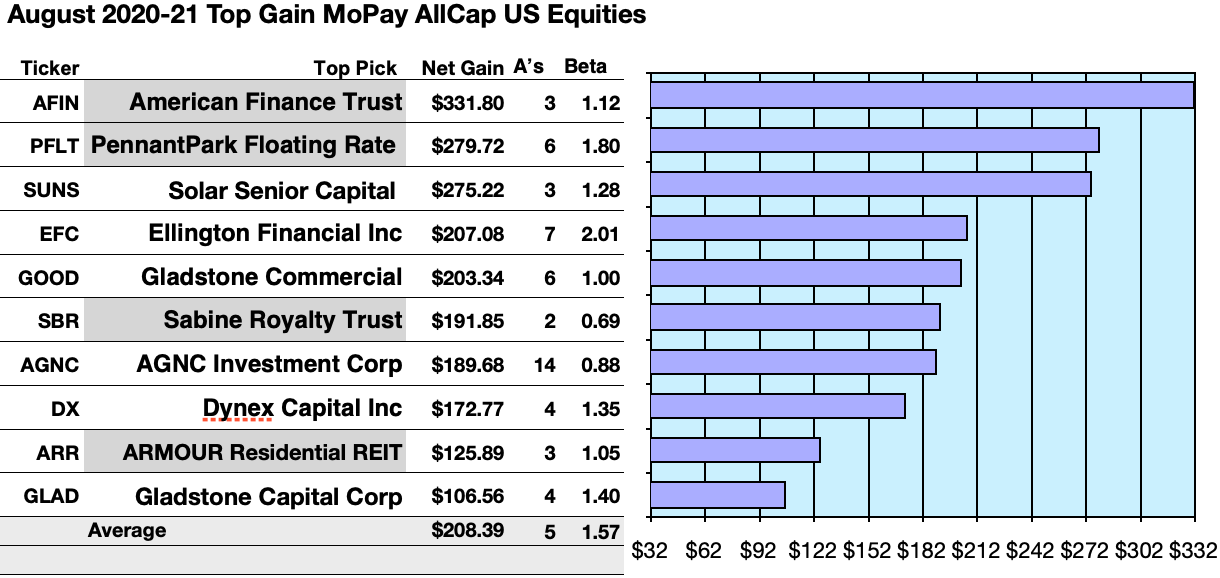

Top monthly dividend stocks. Dynex Capital Inc NYSEDX kicks off our list of the Top 10 Dividend Stocks That Pay Monthly being owned by 8 hedge funds on September 30 including several of the major quant funds. Shaw Communications SJR up 512 PermRock Royalty Trust PRT up 245. Bonus sambutan untuk pemula.

Northland Power is a power producer that develops builds owns and operates clean and green power infrastructure assets in Canada Europe and other global. With a positive future Dynex is one of the best monthly dividend stocks to invest in in 2021. With this context in mind here is a look at the top 10 best monthly dividend stocks.

Ad Buat prediksi dan lihat hasilnya dalam 1 menit. In March 2021 the 3 best-performing monthly dividend stocks including dividends were. 15 Best Monthly Dividend Stocks 1.

Best Monthly Dividend Stocks in 2021 10. 447 rows Two special kinds of dividend stocks that are more likely to issue monthly. Cross Timbers Royalty Trust.

Horizon is another one of the best monthly dividend stocks that generates its income from investments in other firms. Pengaturan trading yang fleksibel. Coba strategi Anda dengan perdagangan kecil mulai dari 1.

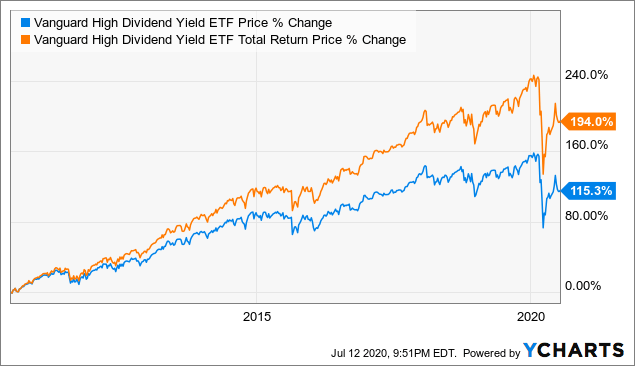

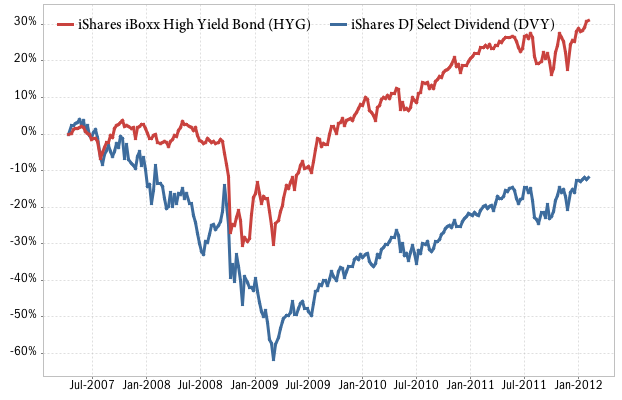

But with a little patience and some short-term-ism from the bears we can get much better value and income out of the same stock. Realty Income is the top monthly dividend stock not just because of a high dividend yield but also its uniquely high level of dividend safety and long history of consistent dividend growth. Bonus sambutan untuk pemula.

Vanguard Total Market Bond ETF BND A fixed-income-focused ETF BND offers a 276 dividend yield. Also Dynex as one of the highest paying monthly dividend stocks which makes it an even more attractive investment. Shaw Communications SBAC SJR Dividend Yield.

Pengaturan trading yang fleksibel. Best Monthly Dividend Stocks. Considering the limited options I picked the top 3 stocks outside of REITs that can provide both stock appreciation and dividend growth.