The vast majority of reverse mortgages are insured through the Federal Housing. With the government insured reverse mortgage HUD HECM borrowers have both 2 upfront and50 annual renewal mortgage insurance premiums MIP to pay.

Reverse Mortgage The Pros And Cons The Truth About Mortgage

Reverse Mortgage The Pros And Cons The Truth About Mortgage

Instead of making monthly mortgage payments to the lender the way you would with a traditional mortgage the lender pays you.

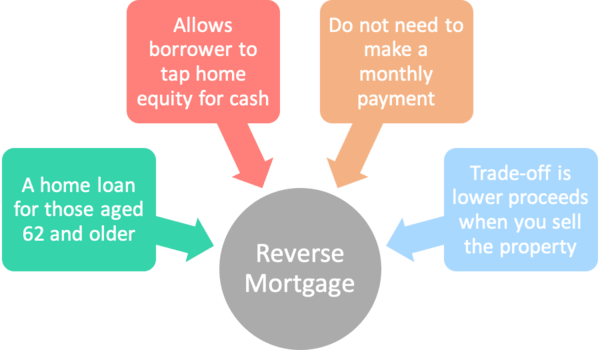

What are the pros and cons of a reverse mortgage. A reverse mortgage allows property owners 62 and older to convert real estate equity into spendable cash. A reverse mortgage is a home-secured loan that can turn part of the equity youve built up in your house into funds you can use today or a line of credit that will be there when you need it. REVERSE MORTGAGE PROS CONS.

Reverse Mortgage Pros and Cons The biggest benefit for a homeowner is that a reverse mortgage allows them to access to useable cash. Reverse mortgages are ideal for retirees who dont have a lot of cash savings or investments but do have a lot of wealth built up in their homes. As the name implies rather.

You can convert the equity in your home into a pile of cash without having to move out. Before you make a decision heres what you need to know about reverse mortgage pros and cons. Get the facts about this highly misunderstood mortgage for seniors.

Taught by Advisory Mortgage LLC. People often ask Is Chip Reverse Mortgage A Good Idea This is not a simple Yes answer type of question because it depends on your situation and what you want. Reverse mortgages can have higher closing costs vs traditional mortgages Reverse mortgages can be expensive loans due to upfront financed origination fees.

The money is tax free. In a nutshell reverse mortgages allow people to borrow against their home without having to make any repayments until its sold. Reverse mortgages are ideal for retirees who dont have a lot of cash savings or investments but do have a lot of wealth built up in their homes the pair writes about the potential for securing a retirement.

Pros and Cons of Reverse Mortgages April 12 2021 To supplement their income after retirement many seniors opt for financial instruments intended to. A reverse mortgage allows you to turn an otherwise illiquid asset into cash that you can use to cover expenses in retirement. Cons of reverse mortgages You could default and potentially lose your home if you dont meet certain requirements With a reverse mortgage you default when you fail.

Specifically designed for homeowners age 62 or 60 in certain. What is a Reverse Mortgage. The Reverse Mortgage Pros and Cons in 2021 April 20 2021 By Admin no comments Theres no doubt that the decision to get a reverse mortgage can be a big one especially depending on the borrowers particular financial situation.

However to make an informed decision it is worth having a few true facts about CHIP Reverse Mortgage. A reverse mortgage is a kind of loan that allows you to cash out your homes equity while you still live in the house. Learn the pros and cons about reverse mortgages and the various ways senior home owners are using this product to improve their lives.

Helps Secure Your Retirement. You dont have to pay back the money until you move out sell the house or pass away. By borrowing against an asset in this case a home itll generate cash flow to settle other debts or help pay for medical bills.

Is Chip Reverse Mortgage A. Pros Potential to receive regular income. Pros and Cons of Reverse Mortgages They are a steady stream of income that lasts for years.