To be safe the 4 rule says you should aim to spend no more than 4 of your total retirement fund in the first year then adjust that amount in subsequent years for. Take the popularized 4 rule as an example.

What Is The 4 Rule How Much Money Do I Need To Retire Youtube

What Is The 4 Rule How Much Money Do I Need To Retire Youtube

For example someone could withdraw 20000 a year with a 500000 retirement fund balance.

What is the 4 rule for retirement. The amount of money you might withdraw each year from the starting value of your portfolio of stock and bonds in retirement. It also assumes youll keep your spending level throughout retirement. And these studies also showed that it would last even longer than a 30-year period which is important for those of us that are retiring early.

The 4 rule assumes your investment portfolio contains about 60 stocks and 40 bonds. The worst-case for a 425 withdrawal rate was 28 years. The 4 Rule is for a 30-year retirement so technically it wont last forever.

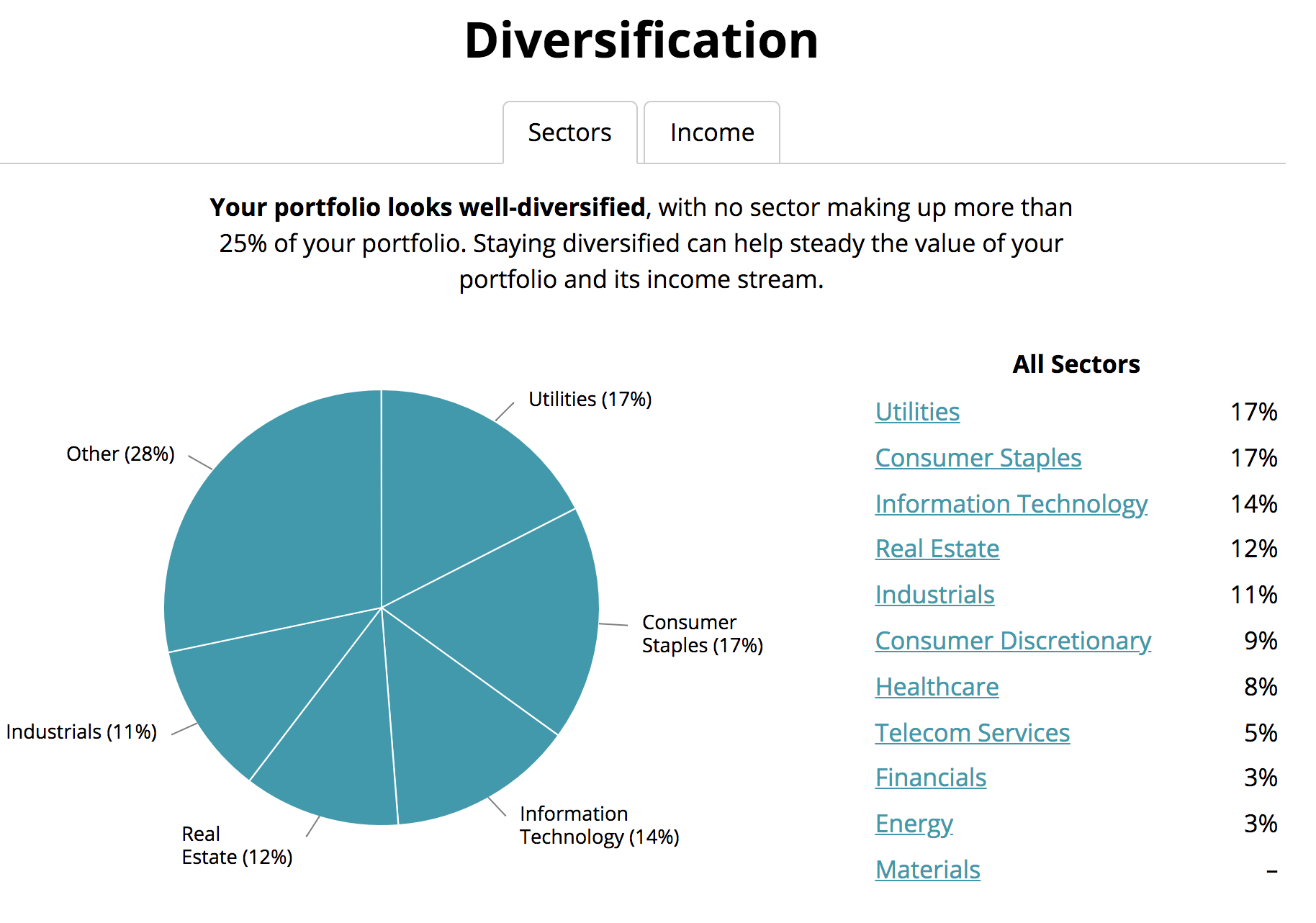

An allocation in the 50-75 range was the sweet spot. If your investment returns are higher than 4 your portfolio will still be increasing in size and upon your eventual death you will still have the nest egg to. The 4 rule assumes a rigid withdrawal rate throughout retirement.

At a high level the 4 rule states a percentage that retirees are said to be able to withdraw annually and still have the funds last for 30 years. Having too much in stocks during retirement is just as risky as having too little in stocks. Bengen wanted to establish a safe rate of withdrawal that would give retirees confidence they.

The 4 rule is designed to answer this question. So that is where the 4 rule came from also known as the safe withdrawal rate. Its a rule of thumb that says you can withdraw 4 of your portfolio value each year in retirement without incurring a.

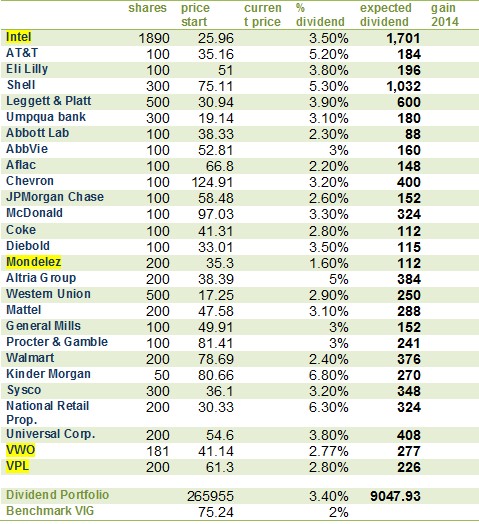

The 4 rule for retirement is a simple concept you save a certain amount and invest in a specific conservative portfolio and every year you withdraw 4 to fund your living expenses. How The 4 Rule Applies To You. The Roots of the 4 Rule The 4 rule was developed by financial planner William Bengen in 1994.

The Four Percent Rule is a rule of thumb used to determine how much a retiree should withdraw from a retirement account each year. The origins of the 4 rule At one point it was believed that the typical retiree could safely withdraw 5 of the original balance of their. However much money you start your retirement off with the 4 rule tells you to withdraw 4 of it in your first retirement.

After that they adjust their annual withdrawals by the rate of inflation. Retirees take out 4 in the first year of retirement. An initial withdrawal rate of 4 was considered safe because it never resulted in a portfolio being exhausted in less than 33 years.

The 4 Rule assumes the accounts allocation is 60 invested in the stock market and 40 invested in bonds. Over the past 25 years the 4 rule has helped many retirement investors plan their savings goals and manage their account withdrawals. For example if you have 100000 when you retire the 4 percent rule would say that you could withdraw about 4 of that amountor 4000the first year of retirement.

Thats why its important to consider your life expectancy as part of your retirement savings plan. When should you use the 4 rule. What Is the Four Percent Rule.

The 4 percent retirement rule refers to your withdrawal rate. How the 4 rule works. The 4 rule says you should withdraw 4 of your retirement each year plus inflation to make your retirement portfolio last 30 years.

But not everyone agrees. So lets figure out your retirement number.

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png)