Sign in to activate a Chase card view your free credit score redeem Ultimate Rewards and more. A maximum of 15 Elite Night Credits will be awarded through this benefit per Marriott Bonvoy Member Account even if the Member has more than one credit card linked to their Marriott Bonvoy Member Account unless you have both a small business Marriott Bonvoy credit card account and a consumer Marriott Bonvoy credit card account.

Best Travel Credit Cards For April 2021 Cnet

Best Travel Credit Cards For April 2021 Cnet

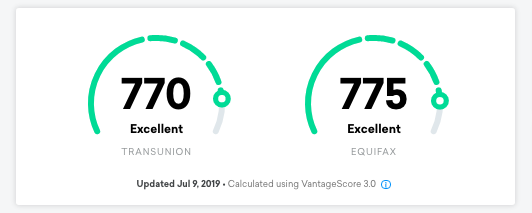

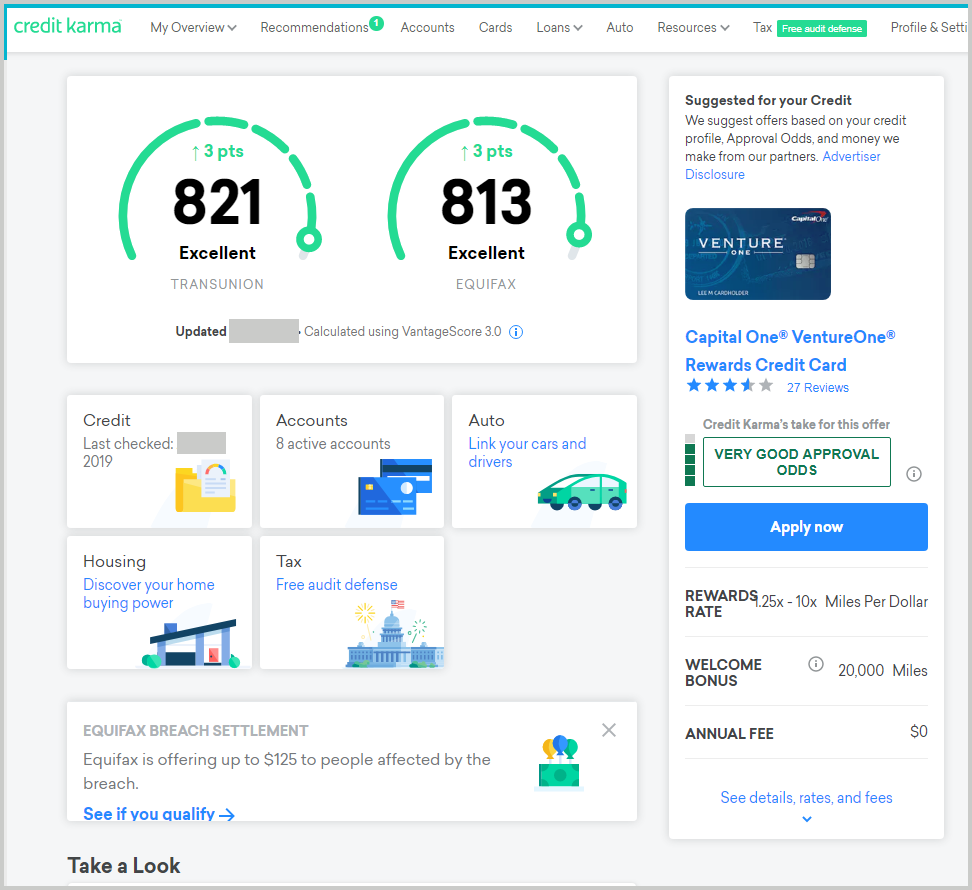

Plus get your free credit score.

Chase travel credit card. Best of all these perks can be found on many of Chases credit cards though youll find the best selection on Chases higher-end cards. Earn 2X on dining and travel. Why its the best credit card for travel credits.

Toll bridges and highways. Parking lots and garages. 31 2021 with any balances.

Opens in a new window Apply Now Opens in a new window. The Chase Sapphire Reserve comes with an annual 300 travel credit. Navigate Travel Credit Cards.

We can help you find the credit card that matches your lifestyle. Be sure to carry at least 1 of these with you while traveling abroad. According to Chase the following purchases DO count as a travel.

Best for Straightforward Earnings. Chase offers a strong variety of travel insurance coverage options including trip cancellation insurance. Thats 1000 when you redeem through Chase Ultimate RewardsPlus earn up to 50 in statement credits towards grocery store purchases within your first year of account opening.

While the Chase Sapphire cards 550 annual fee is steep the yearly travel credit of 300 brings the overall cost down to 250 making the fee more manageable. With general travel airline or hotel credit cards you can enjoy benefits designed to enhance your travel experience such as miles points that you can redeem toward flights or hotel room upgrades and no foreign transaction fees. Earn 80000 bonus points and a 50 statement credit on grocery store purchases.

The following Chase credit cards do not have any foreign transaction fees. What Counts as Travel on Chase Credit Cards. Chase Sapphire Preferred Card - This is our favorite beginners travel rewards card which is currently offering a 80000 point bonus after you spend 4000 on purchases in the first 3 months from account opening.

Types of travel rewards cards. If your credit card includes travel insurance you may be reimbursed if your travel is affected by weather health issues or certain kinds of emergencies outside your control. A statement credit will automatically be applied to your account when your card is used for purchases in the travel category up to an annual maximum accumulation of 300.

Even though its a relatively inexpensive travel credit card the Chase Sapphire Preferred offers a surprising amount of protection when it comes to. A general travel credit card will provide you flexibility in how you earn and redeem your reward points. Best Chase Credit Cards.

Chase Sapphire Preferred Card. This is great if you are traveling or driving through tolls on the highway especially since the annual fee on this card is 450. Best for Category Bonuses.

Chase Sapphire Preferred Credit Card. Many offer rewards that can be redeemed for cash back or for rewards at companies like Disney Marriott Hyatt United or Southwest Airlines. Plus that 300 annual credit has been expanded through Dec.

Credit card travel insurance protects you from some unforeseen circumstances that may disrupt your travel plans. Not only will traditional transactions like airfare qualify for a statement credit but purchases such as parking garage tickets are also eligible. Getting an annual travel credit of 300 is a nice way to balance this out.

7 300 Annual Travel Credit. Typically credit card travel insurance only covers the expenses that you charge to that specific card. The Chase Sapphire Reserve has many great selling points but for me and many others one of them is the 300 in annual travel credit.

The Chase Sapphire Reserve annual 300 travel credit is awarded each year that you have the card and it is ready to use as soon as you open your new account. But rather than limiting that credit to airline incidental fees as competing cards do you can use it to offset several travel expenses such as airfare hotels rental cars transit and more. Sign in to apply faster Opens in a new window.

Personal Chase Credit Cards With No Foreign Transaction Fees. There are plenty of Chase credit cards that waive the standard 3 foreign transaction fee. In most cases when this credit resets it is tied to a cardmember year not a calendar year.

Choose from our Chase credit cards to help you buy what you need. Travel cards Explore the world and earn premium rewards with Chase Sapphire Reserve or Chase Sapphire Preferred. The Chase Sapphire Reserve cards travel credit is one of the most flexible offered by a rewards card encompassing all kinds of travel purchases.

Then you may receive a combined maximum of 30 Elite Night Credits 15 per credit card. Annual means the year beginning with your account open date through the first statement date after your account open date anniversary and the 12 monthly billing cycles after that each year.

:max_bytes(150000):strip_icc()/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg)