267 rows AAM SP 500 High Dividend Value ETF. Global X Guru Index ETF.

Vanguard Funds Plc Share Price Vusa S P 500 Ucits Etf Usd Gbp Vusa

386 106 DATA AS OF Apr 01 2021.

Vanguard s&p 500 dividend. The 30-day SEC yield for Vanguard ETFs ranges between 036 and 535 as of May 2020. Global X Scientific Beta US ETF. The Vanguard SP 500 VOO ETF granted a 181 dividend yield in 2020.

Large Cap Buffer20 Apr ETF. 37 rows Dividend History VFV Vanguard SP 500 Index ETF redeemable transferabl. Data is currently not available.

VOOs most recent quarterly dividend payment was made to shareholders of. The dividends in the fund are distributed to the investors Quarterly. Dividend History VSP Vanguard SP 500 Index ETF CAD-hedged Payout Date.

The total expense ratio amounts to 007 pa. VOO Dividend History Description Vanguard SP 500 ETF. Because dividends are taxable if you buy shares of a stock or a fund right before a dividend is paid you may end up a little worse off.

While it is fairly uncommon there are a few Vanguard funds that pay dividends monthly. Vanguard SP 500 ETF pays an annual dividend of 539 per share with a dividend yield of 140. Vanguard SP 500 ETF VOO dividend gowth summary.

Global X SP 500 Quality Dividend ETF. SP 500 allows a broad investment with low fees in 500 stocks. - Vanguard SP 500 ETF VOO Dividend History The fund employs an indexing investment approach designed to track the performance of the Standard Poors 500 Index a widely recognized benchmark of US.

Stock market performance that is. Investor Shares Admiral Shares Signal Shares and ETF Shares. The fund offers four classes of shares.

The fund employs an indexing investment approach designed to track the performance of the SP 500 Growth Index which represents the growth companies as determined by the index sponsor of the SP 500 Index. ETF Dividend Yield The most recent Dividend Yields of Vanguard SP 500 VOO ETF are represented below. As of Dec 31 2013 the Funds investments portfolio was valued at 160159972000.

SPDR SP 500 Buyback ETF. Dividend information for Vanguard SP 500 UCITS ETF IE00B3XXRP09 plus portfolio overview latest price and performance data expert insights and more Personal Investing Investing with an adviser. By month or year chart.

1 year growth rate TTM. Overlay Shares Large Cap Equity ETF. The Vanguard SP 500 UCITS ETF invests in stocks with focus United States.

Declare date ex-div record pay frequency amount. Vanguard Index Funds - Vanguard SP 500 ETF is an open-end management investment company. Learn more about the VOO Vanguard SP 500.

Vanguard SP 500 ETF VOO Nasdaq Listed. The index measures the performance of large-capitalization growth companies in the United States. Vanguard SP 500 ETF VOO dividend growth history.

46 rows The previous Vanguard SP 500 UCITS ETF dividend was 24c and it went ex 27 days ago. 3 5 10 year growth rate CAGR and dividend growth rate. Dividends are payments of income from companies in which you own stockIf you own stocks through mutual funds or ETFs exchange-traded funds the company will pay the dividend to the fund and it will then be passed on to you through a fund dividend.

Vanguard S P 500 Vs Spdr S P U S Dividend Aristocrats Shares And Etfs Ig Community

Vanguard S P 500 Vs Spdr S P U S Dividend Aristocrats Shares And Etfs Ig Community

What S The Best S P500 Etf Spy Vs Voo Vs Ivv Stock Analysis

What S The Best S P500 Etf Spy Vs Voo Vs Ivv Stock Analysis

75 Of S P 500 Returns Come From Dividends 1980 2019 Gfm Asset Management

75 Of S P 500 Returns Come From Dividends 1980 2019 Gfm Asset Management

5 Funds That Crush The S P 500 And Pay 9 3 Dividends

5 Funds That Crush The S P 500 And Pay 9 3 Dividends

Which Vanguard Dividend Etf Is Winning The Race In 2018 The Motley Fool

Which Vanguard Dividend Etf Is Winning The Race In 2018 The Motley Fool

Voo Vanguard S P 500 Etf Dividend History Dividend Channel

Vanguard S P 500 Ucits Etf Vusa Dividends

Vanguard S P 500 Ucits Etf Vusa Dividends

Better Buy Vanguard High Dividend Yield Etf Vs Spdr S P Dividend Etf The Motley Fool

Better Buy Vanguard High Dividend Yield Etf Vs Spdr S P Dividend Etf The Motley Fool

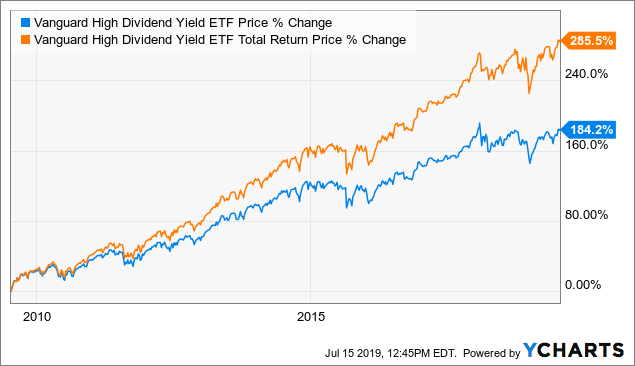

Vym Is A Low Risk Dividend Fund That Offers Decent Returns Nysearca Vym Seeking Alpha

Vym Is A Low Risk Dividend Fund That Offers Decent Returns Nysearca Vym Seeking Alpha

Start 2021 With This 6 4 Cash Dividend With Big Gains Ahead Nasdaq

Start 2021 With This 6 4 Cash Dividend With Big Gains Ahead Nasdaq

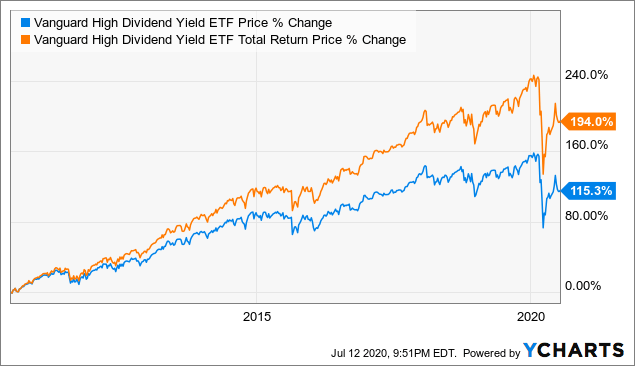

Vanguard High Dividend Yield Etf Should Benefit From The Current Low Rate Environment Nysearca Vym Seeking Alpha

Vanguard High Dividend Yield Etf Should Benefit From The Current Low Rate Environment Nysearca Vym Seeking Alpha

The Right Reason To Buy Into Vanguard S Classic Morningstar

The Right Reason To Buy Into Vanguard S Classic Morningstar

5 Funds That Crush The S P 500 And Pay 9 3 Dividends

5 Funds That Crush The S P 500 And Pay 9 3 Dividends

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.