Social Security is taxed only on the first 137700 in earnings annually as of 2020 and 142800 in 2021. Those who earn more than the taxable maximum which.

The Social Security Administration Made A Mistake Sound Mind Investing

The Social Security Administration Made A Mistake Sound Mind Investing

We use the following earnings limits to reduce your benefits.

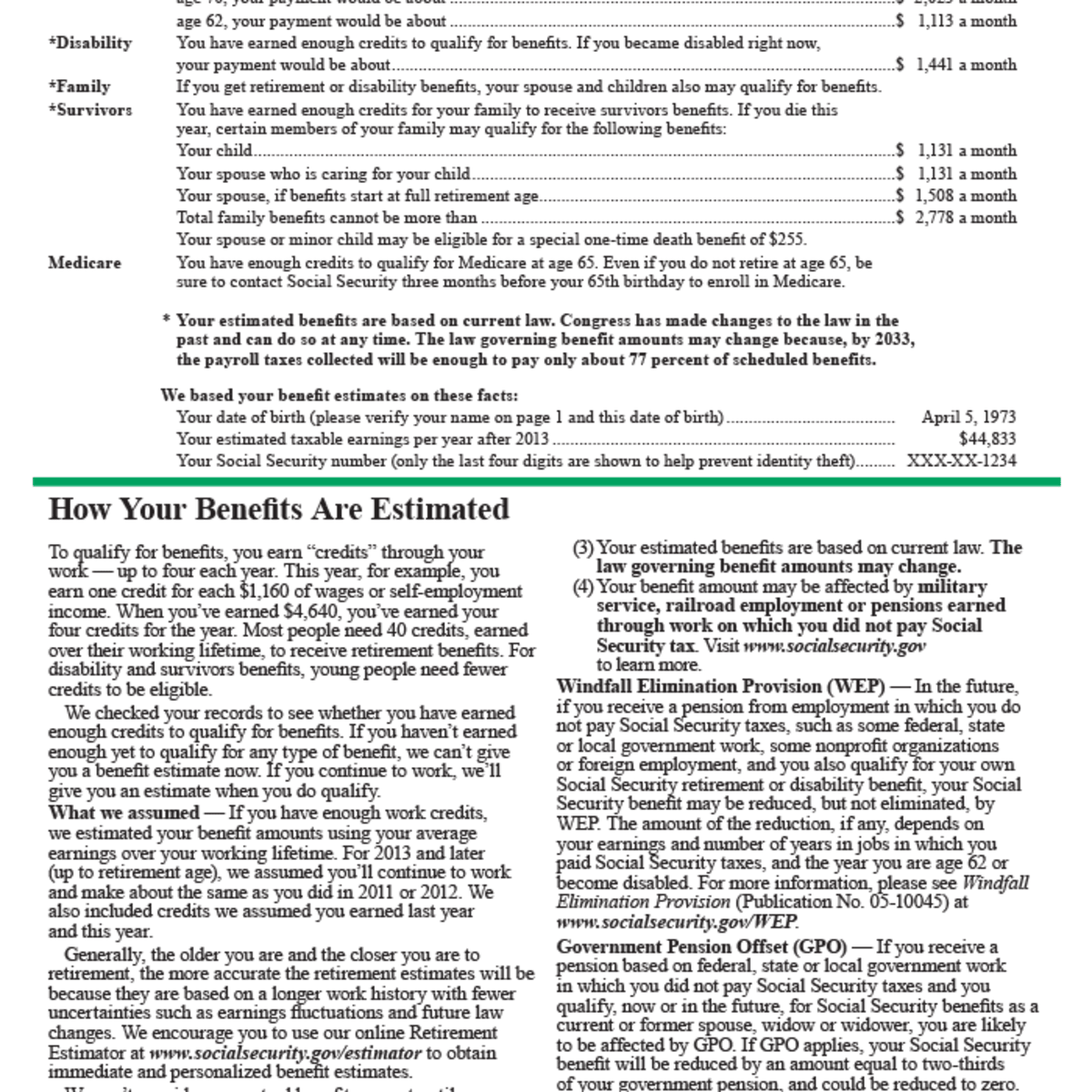

Social security earnings. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099 Social Security Benefit Statement and you report that amount on line 6a of Form 1040 US. In the year you reach full retirement age we deduct 1 in benefits for every 3 you earn above a different. Social Security calculates your benefit amount based on your earnings over the years whether you were self-employed or worked for another employer.

If you will reach FRA in 2021 the earnings limit goes up to 50520 and 1 is deducted from your benefits for every 3 you earn over that. In 2020 the annual Social Security earnings limit for those reaching full retirement age FRA in 2021 or later is 18240. Farm Self Employment Questionnaire.

Request for Social Security Earnings Information. Theres a cap on the earnings that are taxed by Social Security and used to calculate payments. The more money you earned the more you paid.

All other income is exempt including pensions interest annuities IRA distributions and capital gains. Specifically the Social Security earnings test says that in any year for which you will be younger than full retirement age throughout the entire year for every two dollars you make in excess of a certain threshold 18240 for 2020 one dollar of your Social Security benefit or somebody elses benefit on your work record will be withheld. Request for Correction of Earnings Record.

It applies to all earnings. The taxable portion of the benefits that. Well say that your calculated Social Security benefit including the permanent reduction for claiming early is 1400 per month.

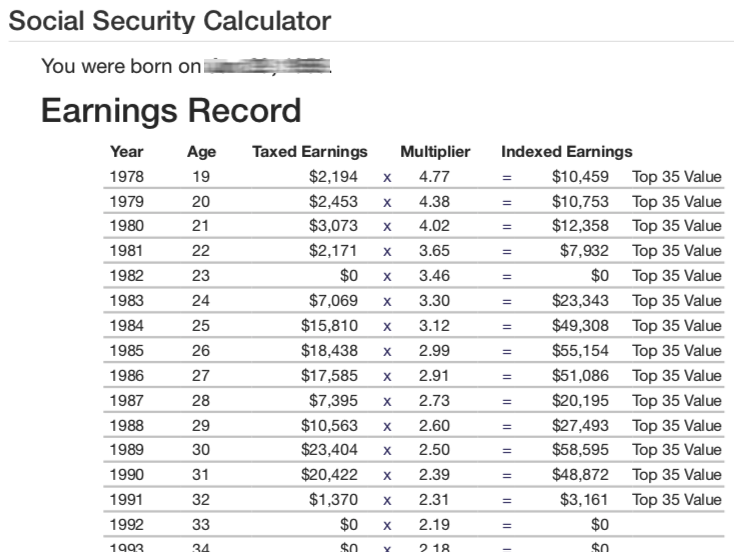

So if you are a high-income earner and earned 60000 in the first half of the year then reach FRA and begin your Social Security in the fall the earnings. The Social Security benefits calculation uses your highest 35 years of earnings to calculate your average monthly earnings. For 2021 that limit is 18960.

You still work and your salary is 36000 in 2020 or 3000 per. During the year you reach FRA Social Security only counts earnings that you receive before the month you reach FRA. Your pre-WEP benefit will be based on the 24 years of earnings in the Social Security-taxed job.

Once your income exceeds that point youll have 1 in Social Security withheld for every 2 you earn. A free and secure my Social Security account provides personalized tools for everyone whether you receive benefits or not. Full retirement age is based on your year of birth.

From your description you have this covered. If you do not have 35 years of earnings a zero will be used in the calculation which will lower the average. The Social Security income limit applies only to gross wages and net earnings from self-employment.

Request for Social Security Statement. In 2021 the limit is 18950 for those reaching their full retirement age in 2022 or later. You can use your account to request a replacement Social Security card check the status of an application estimate future benefits or.

In 2019 the annual earnings limit for those achieving full retirement age in 2020 or later was 17640. Individual Income Tax Return or Form 1040-SR US. If you collect Social Security benefits during the year you reach FRA Social Security will deduct 1 in benefits for every 3 you earn over the limit.

For a worker who becomes eligible for Social Security payments in 2021 the benefit amount is calculated by multiplying the first 996 of average indexed monthly earnings by 90 the remaining. If you are under full retirement age for the entire year we deduct 1 from your benefit payments for every 2 you earn above the annual limit. Tax Return for Seniors.

Therefore in any year your Social Security Earnings used in calculating AIME are your wage or salary income including any retirement contributions made by. In 2021 that limit is increasing to 18960. The first measure is eligibility for Social Security retirement benefits which requires 40 quarters of earnings based on a Social Security-taxed job.

In 2021 if you collect benefits before full retirement age and continue to work the Social Security Administration will temporarily withhold 1 in benefits for every 2 you earn over 18960.

Retirement Benefit Calculations 2019 Social Security Retirement Guide

Retirement Benefit Calculations 2019 Social Security Retirement Guide

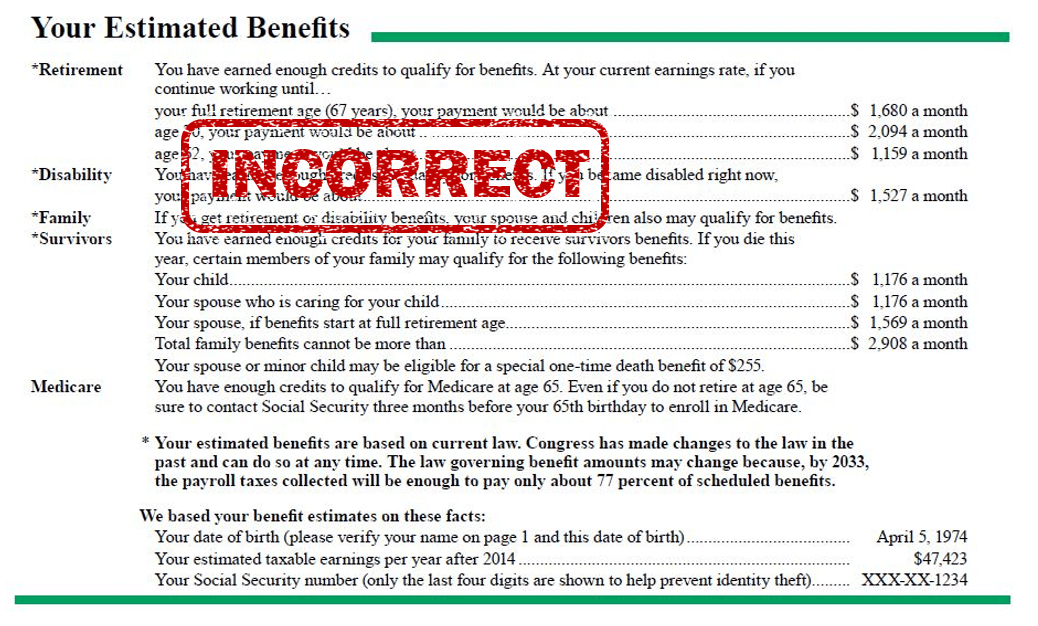

Subject To The Wep Your Social Security Statement Is Probably Wrong Social Security Intelligence

Subject To The Wep Your Social Security Statement Is Probably Wrong Social Security Intelligence

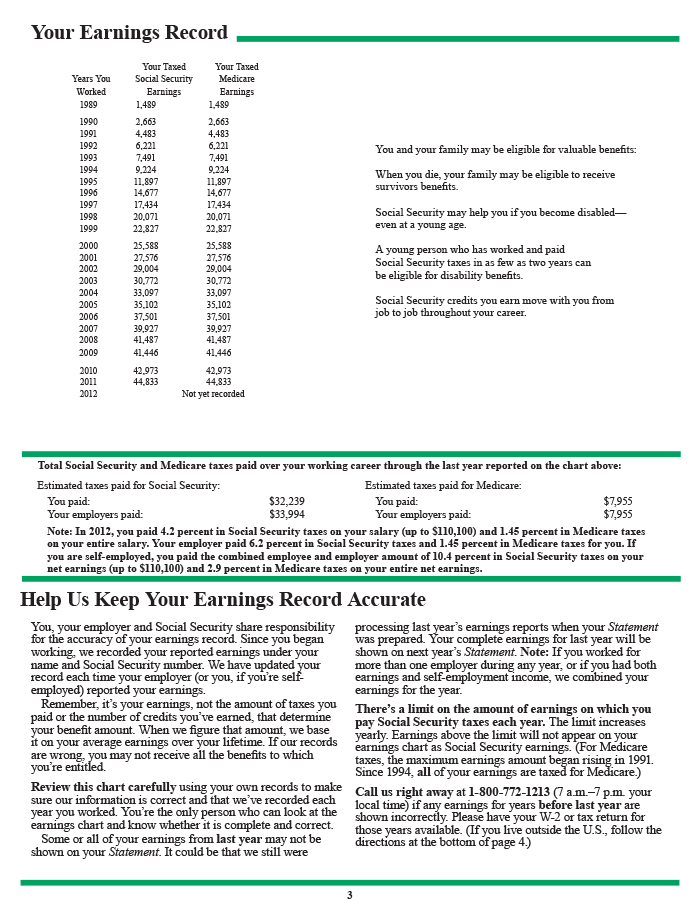

Reviewing Social Security Statements To Make Corrections

Reviewing Social Security Statements To Make Corrections

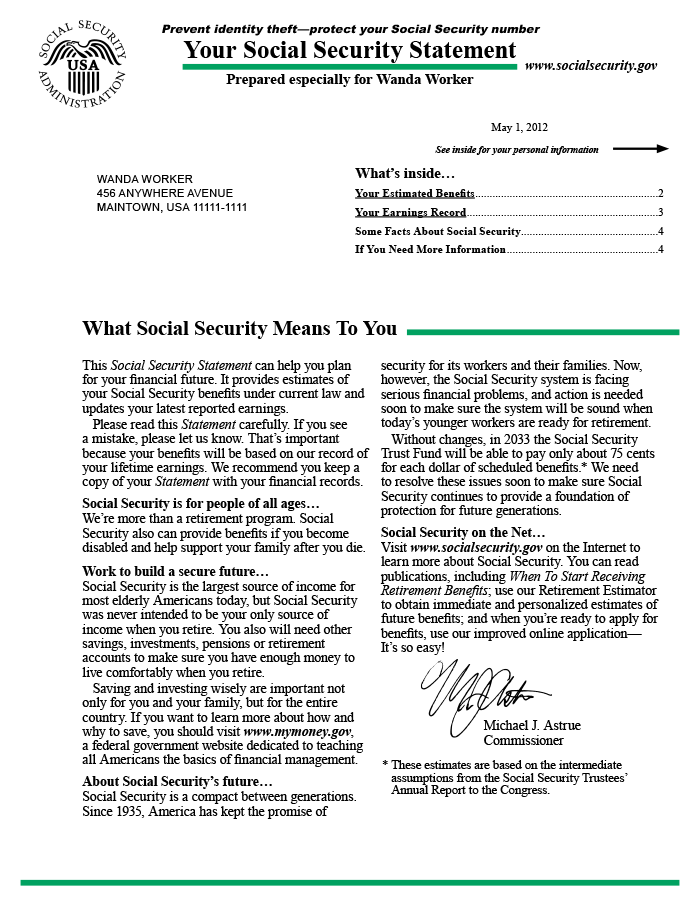

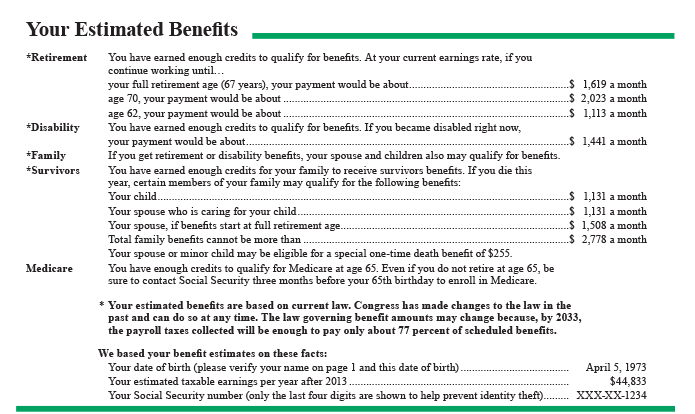

The Social Security Statement Background Implementation And Recent Developments

The Social Security Statement Background Implementation And Recent Developments

The Social Security Statement Background Implementation And Recent Developments

The Social Security Statement Background Implementation And Recent Developments

/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png) Learn About Social Security Income Limits

Learn About Social Security Income Limits

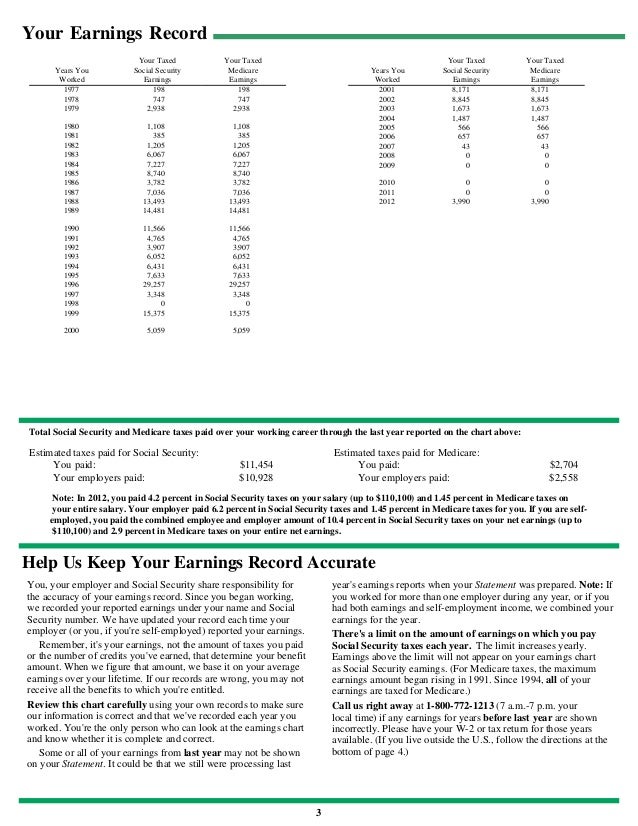

How To Transfer Or Correct Your Earnings On Your Social Security Statement Toughnickel

How To Transfer Or Correct Your Earnings On Your Social Security Statement Toughnickel

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Paying Social Security Taxes On Earnings After Full Retirement Age

Paying Social Security Taxes On Earnings After Full Retirement Age

Ssa Poms Rm 01310 010 Information Contained In The Social Security Statement 04 01 2013

Ssa Poms Rm 01310 010 Information Contained In The Social Security Statement 04 01 2013

The Social Security Statement Background Implementation And Recent Developments

The Social Security Statement Background Implementation And Recent Developments

Checking Your Social Security Earnings Record Social Security Intelligence

Checking Your Social Security Earnings Record Social Security Intelligence

How To Calculate Your Social Security Benefit Mrmillennialmoney

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.