If you make more than 18960 in 2021 for every 2 over the limit 1 of your Social Security benefit will be withheld. Half of that would be 9258.

The Average Social Security Benefit Is Not Enough For Retirement

The Average Social Security Benefit Is Not Enough For Retirement

Then lets say you have a combined income of 30000.

How much will my social security benefit be. It shows the total amount of benefits you received from us in the previous year so you know how much Social Security income to report to the IRS on your tax return. Fifty percent of a taxpayers benefits may. For retirement benefits the number of computation years always equals 35 and these computation years are the only ones used when calculating your Social Security benefit.

In June of last year there were 437 million retired workers and their dependents receiving 57 billion a year in benefits. The maximum Social Security benefit in 2020 is 3790. Multiply that by 12 to get 46740 in maximum annual benefits.

To collect this you would. Yes there is a limit to how much you can receive in Social Security benefits. For 2021 its 3895month for those who retire at age 70 up from 3790month in 2020.

The average Social Security check in 2020 is 1503. If they are married filing jointly they should take half of their Social Security plus half of their spouses Social Security and add that to all their combined income. Estimate Your Retirement Benefits.

Say youre a single filer who receives a monthly benefit of 1543 the average benefit after the cost of living increase in January 2021. The Benefit Statement also known as the SSA-1099 or the SSA-1042S is a tax form we mail each year in January to people who receive Social Security benefits. The Social Security Administration SSA publishes a chart that shows the maximum amount in dollars rather than percentages that your Social Security benefits would be reduced based on the number of years you paid Social Security taxes.

Until you reach full retirement age your. The average monthly retirement benefit this past January was 1360. Check out this section of my video that goes over this calculation step-by-step.

So benefit estimates made by the Quick Calculator are rough. If you plan to work in retirement and also collect Social Security benefits some of your benefits may be temporarily withheld based on your income. If that total is more than 32000 then part of their Social Security may be taxable.

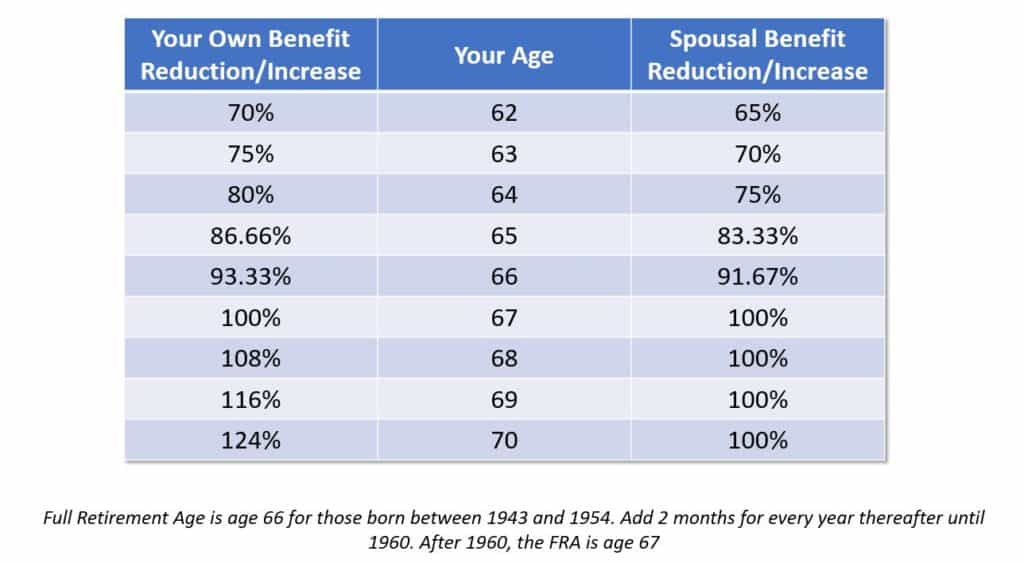

As complicated as Social Security benefits can seem there is a way to correctly calculate how much your spousal benefit will be if you qualify to receive it. If you start collecting your benefits at age 65 you could receive approximately 33773 per year or 2814 per month. A six-figure salary translates into a benefit thats between those two numbers --.

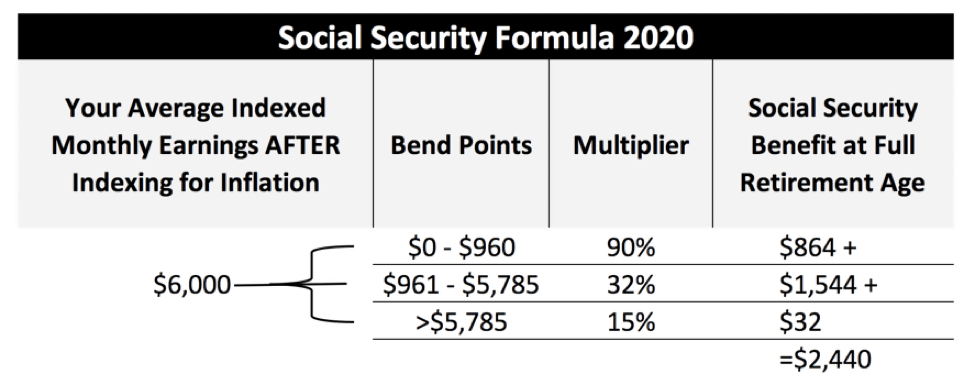

Under current law this means that as soon as you turn 62 the bend points for your benefits will be set in stone. It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to the IRS on your. Instead it will estimate your earnings based on information you provide.

Your total annual benefits would be 18516. Please keep in mind that these are just estimates. Taxable Social Security Benefit Calculator.

Note that not everyone pays taxes on benefits but clients who have other income in retirement beyond Social Security will likely pay taxes on their benefit. Benefit estimates depend on your date of birth and on your earnings history. A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefits.

Consider the Average Social Security Payment The average Social Security benefit was 1543 per month in January 2021. This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable. Figuring out how much you can expect every month when you retire depends on a few criteria.

Social Security Quick Calculator. If there arent 35 years zeros are substituted in until the calculation has 35 years worth of income. The Retirement Estimator gives you a benefit amount based on your actual Social Security earnings record.

We cant give you your actual benefit amount until you apply for benefits. This is 447 of your final years income. The maximum Social Security benefit changes each year.

For security the Quick Calculator does not access your earnings record. Social Security may provide 33773. The year you reach full retirement age this limit changes to 1 in benefits.

If they are single and that total comes to more than 25000 then part of their Social Security benefits may be taxable. The rules are complicated so check with the SSA if. Its worth noting that Social Security has had a lot of practice at this task.

In 2020 the average Social Security benefit is 1503 monthly and the maximum benefit is 3790.

When To Take Social Security Retirement Benefits

When To Take Social Security Retirement Benefits

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

When Should You Start Social Security Benefits Do The Math Cbs News

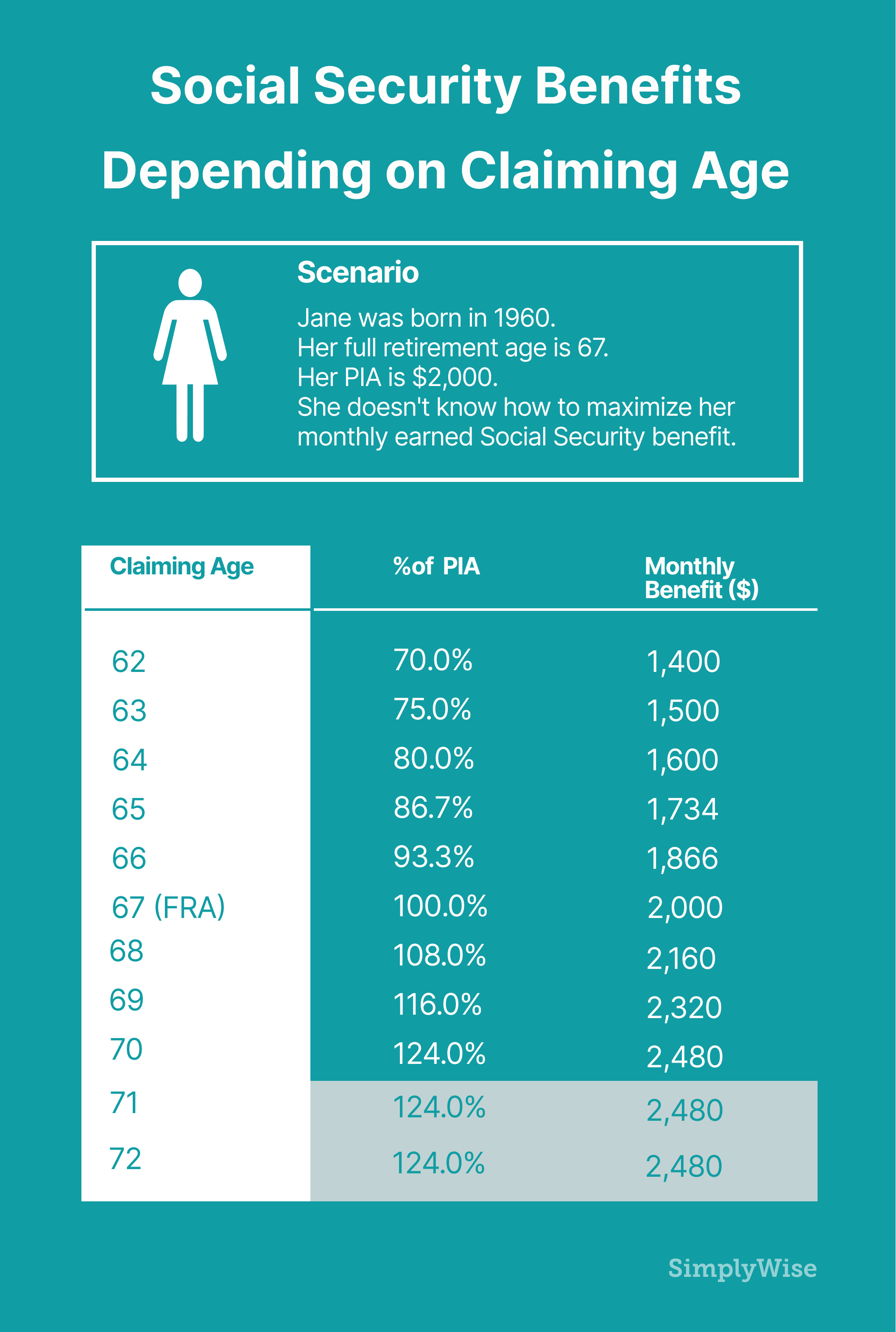

Study Only 1 In 300 Seniors Know These 5 Social Security Rules Simplywise

Study Only 1 In 300 Seniors Know These 5 Social Security Rules Simplywise

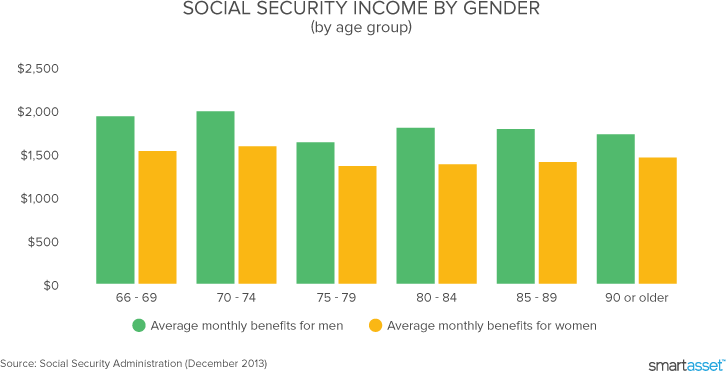

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

How Does Social Security Work Top Questions Answered Ramseysolutions Com

How Does Social Security Work Top Questions Answered Ramseysolutions Com

Calculating Social Security Benefits A Hypothetical Example Of A Higher Download Table

Calculating Social Security Benefits A Hypothetical Example Of A Higher Download Table

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

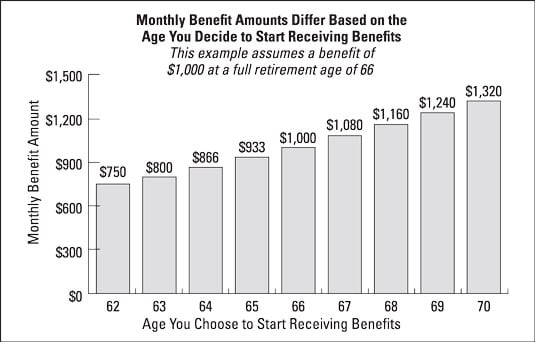

How To Estimate How Much Social Security You Ll Get Each Month Dummies

How To Estimate How Much Social Security You Ll Get Each Month Dummies

Social Security Spousal Benefits The Complete Guide

Social Security Spousal Benefits The Complete Guide

How To Calculate Your Social Security Benefits A Step By Step Guide Social Security Intelligence

How To Calculate Your Social Security Benefits A Step By Step Guide Social Security Intelligence

Everything You Need To Know About Social Security Retirement Benefits Simplywise

Everything You Need To Know About Social Security Retirement Benefits Simplywise

How Early Retirement Reduces Projected Social Security Benefits

How Early Retirement Reduces Projected Social Security Benefits

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.