According to the Las Vegas Sun Nevada collected 1976 million for the fund from gas taxes in 2008 compared to 2106 million in 2018. State-imposed taxes and fees can account for anywhere from roughly 5 of the total cost of gas to more than 20 depending on where you live.

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

Just as the cost of gasoline varies considerably from state to state so does the.

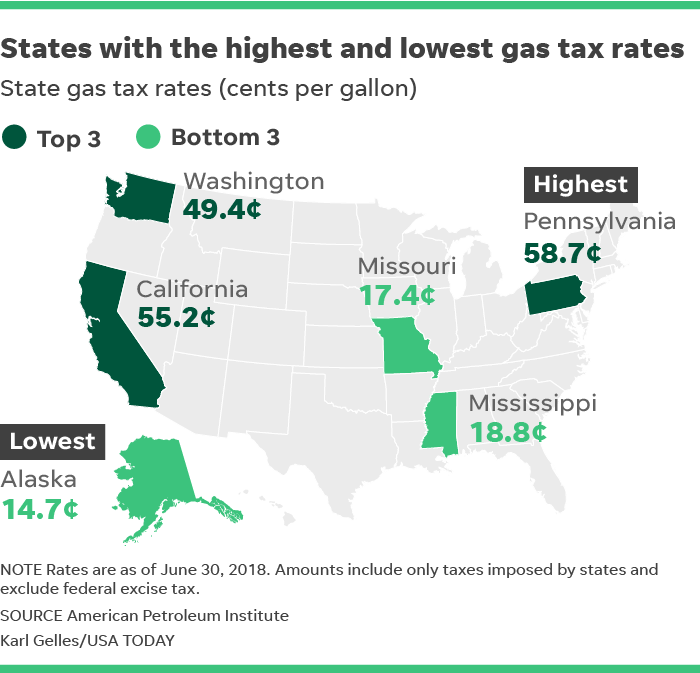

Highest gas tax by state. Topping the list of states with the highest gas taxes is Pennsylvania at 7710 cents per gallon according to the numbers by the American Institute of Petroleum. Still from a historic perspective the price of gasoline today is relatively inexpensive in the United States. California pumps out the highest tax rate of 6247 cents per gallon followed by Pennsylvania 587.

How High Are Gas Taxes in Your State. Drivers in Atlanta and throughout Georgia have been paying a higher gas tax since 2015. Reviewed data on average state gas taxes in January 2021 from the American Petroleum Institute.

In addition to state taxes of at least 4 per gallon of gas the federal government levies a tax of 184 cents on every gallon of gas sold in the US. 5287 cents per gallon Georgias gasoline tax has been higher since the summer of 2015 when a 67-cent increase took effect the first hike in. The state with the highest tax rate on.

As recently as 2012 the average price was over 4 per gallon adjusted for. Sönnichsen Sep 30 2020 Pennsylvania had one of the highest taxes on gas in the United States at. To determine the highest and lowest gas taxes in.

It also looks like. Alaskans pay only 1377 cents in taxes per gallon while Californians need to cough up 6247 cents per gallon. ESB Professional Shutterstock Drivers in Atlanta and throughout Georgia have been paying a higher gas tax since 2015.

California in addition to having the highest average gas price in the country also has the highest gas tax. States with the highest gas tax and price 2020 Published by N. 5070 cents per gallon 377 greater than national average.

52 rows Which State has the Highest Tax Rate. 51 rows Across the board California Hawaii and New Jersey have the highest taxes in the US. A good portion of the fund is financed through the states gasoline tax.

State-imposed taxes and fees can account for anywhere from about 5 of the total cost of gas to more than 20 depending on where one lives. 5355 cents per gallon Georgias gasoline tax has been rising since the summer of 2015 when a 67-cent increase took effect the first hike in the states fuel tax since 1971. Compare 2020 state fuel excise taxes by state 2020 gas tax rates by state and 2020 state gas tax rates with new map.

Click here to see the states with the lowest and highest gas taxes. To determine the highest and lowest gasoline taxes in every state 247 Wall St. California Americas largest state by far based on population has an average state gas tax of 061 per gallon.

Pennsylvania lowered taxes by six tenths of a cent but the state still has the highest gas taxes in the country. 51 rows The five states with the highest gas taxes are.

.png) Map State Gasoline Tax Rates Tax Foundation

Map State Gasoline Tax Rates Tax Foundation

Gasoline Tax By State Page 4 Line 17qq Com

Gasoline Tax By State Page 4 Line 17qq Com

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

Why Are Gas Taxes So High John Locke Foundation John Locke Foundation

Highest Price Ever Of Gasoline In March Financial Sense

Highest Price Ever Of Gasoline In March Financial Sense

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Rising Gas Taxes Which States Have Highest And Lowest Rates

Rising Gas Taxes Which States Have Highest And Lowest Rates

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

Connecticut S State Gas Tax Is Sixth Highest In The Us Two States Seek To Defeat Increases Connecticut By The Numbers

Highest Gas Tax And Prices In The U S By State 2020 Statista

Highest Gas Tax And Prices In The U S By State 2020 Statista

Map Of State Gasoline Tax Rates In 2014 Tax Foundation

Map Of State Gasoline Tax Rates In 2014 Tax Foundation

Gas Tax By State 2020 Current State Diesel Motor Fuel Tax Rates

Gas Tax By State 2020 Current State Diesel Motor Fuel Tax Rates

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.