Working with an unbiased independent broker like Policygenius helps you find a company that is favorable for your budget coverage needs and health. The investor purchases the policy for much less than the face value.

Life Insurance Policy Best Life Insurance Plans In India Max Life Insurance

Life Insurance Policy Best Life Insurance Plans In India Max Life Insurance

Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

Buy life insurance policy. The process of purchasing an online life insurance policy is much easier and quicker. Ad Find American Family Insurance Homeowners and Related Articles. Any individual either male or female falling into the age-group of 18-65 years can buy life insurance in India as per the life insurance terms conditions Here are some other related aspects of buying life insurance you must know.

Shop around for a life insurance policy. Wherever you are in your life we can offer a term life insurance policy to help meet your needs and provide the security you want. How does a buy-sell life insurance agreement work.

If you buy level term insurance then the payout is the same whether you die in year one or the 25th year. Buying life insurance necessitates enough time and commitment. The perks of buying a life insurance policy are beyond protecting the policyholders family in tough times.

It is dependent on the life insurance policy you buy. You can either purchase a new policy or can assign an existing life insurance policy to the bank. If I opt for a Rs 60 lakh cover now can I increase the.

The earlier you buy life insurance the more you gain from the policy. I am planning to purchase a term plan. Because every life insurance company evaluates each application on an individual basis youll pay the most affordable premiums by shopping around with multiple insurers as opposed to working with just one.

Life insurance can be an essential part of your overall financial plan. Ad Find American Family Insurance Homeowners and Related Articles. When taking out a buy-sell life insurance agreement business partners purchase life insurance policies on the lives on each co-owner but not on themselves.

A major purpose of life insurance is to help your dependents replace your income if you die. A cheaper alternative is decreasing term insurance where the payout gradually becomes smaller over the years. The fragility and uncertainty of life prompted the necessity of including life insurance as an essential financial tool.

Forgoing life insurance purchases at a young age can be costly. Thus the cost of premiums is an important factor in policy valuation. The purchase of other peoples life insurance policies is a viatical transaction.

A life insurance quote reflects what youll be billed for but doesnt tell you anything about a policys internal costs such as expenses and fees and the cost of insurance within the policy. And if you qualify you can even buy life insurance online. Get a Term Life Insurance Quote.

By just answering a few simple questions you can get a term life insurance quote quickly and easily. The average cost of a 20-year level term policy with a 250000 face amount is about 214 per year for a healthy 30-year-old male. With the advanced technologies all the details are available in one click and the whole process of comparing the proposal choosing the policy reviewing the terms and conditions and initiating.

Just like non-smokers even smokers can avail life insurance though the rate of the premium may differ. If a co-owner dies other co-owners are paid a lump-sum benefit thats forwarded to the deceaseds surviving family members. This practice became popular in the 1980s as AIDs victims began to show up more frequently.

Buy Life Insurance Policy Apr 2021. As noted the buyer of a life insurance policy will need to continue paying premiums until the policyholder passes away. Many people tend to postpone the idea of life insurance misconceiving that there is always more time to buying one.

Low premiums mean the policy is cheaper to maintain which results in a higher life settlement value. Undoubtedly it is a necessity for a breadwinner to safeguard their dependents in case of their unfortunate and untimely demise accident or physical disabilities that lead to a loss of income. You can buy life insurance.

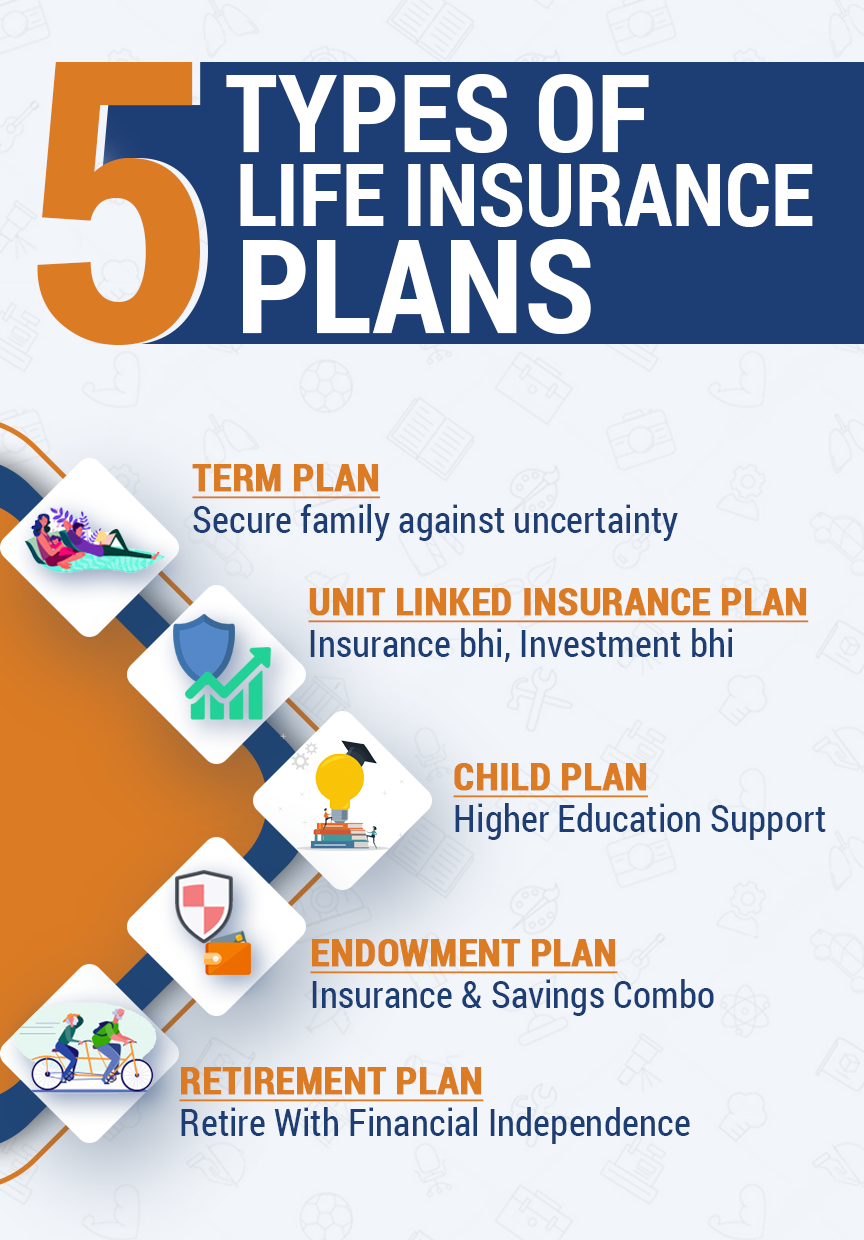

Life Insurance Best Life Insurance Plans In India 2021

Life Insurance Best Life Insurance Plans In India 2021

5 Reasons Why You Must Invest In A Term Life Insurance Policy

5 Reasons Why You Must Invest In A Term Life Insurance Policy

Should You Buy Life Insurance Coverage Online Insurance Quote

Should You Buy Life Insurance Coverage Online Insurance Quote

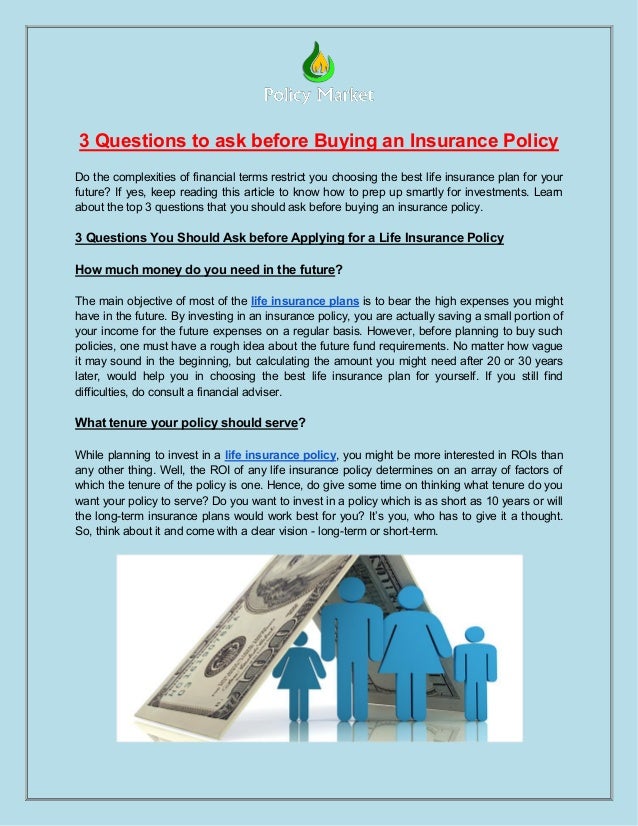

3 Questions Before Buying Life Insurance Policy

3 Questions Before Buying Life Insurance Policy

Ppt Five Things That Will Convince You To Buy Life Insurance Policies Powerpoint Presentation Id 7756038

Ppt Five Things That Will Convince You To Buy Life Insurance Policies Powerpoint Presentation Id 7756038

How To Get Life Insurance For Parents The Ultimate Guide

How To Get Life Insurance For Parents The Ultimate Guide

Buying Life Insurance A Shopping Checklist

Buying Life Insurance A Shopping Checklist

Average Life Insurance Rates For 2021 Policygenius

Average Life Insurance Rates For 2021 Policygenius

5 Questions You Need To Answer While Buying Life Insurance Business News India Tv

5 Questions You Need To Answer While Buying Life Insurance Business News India Tv

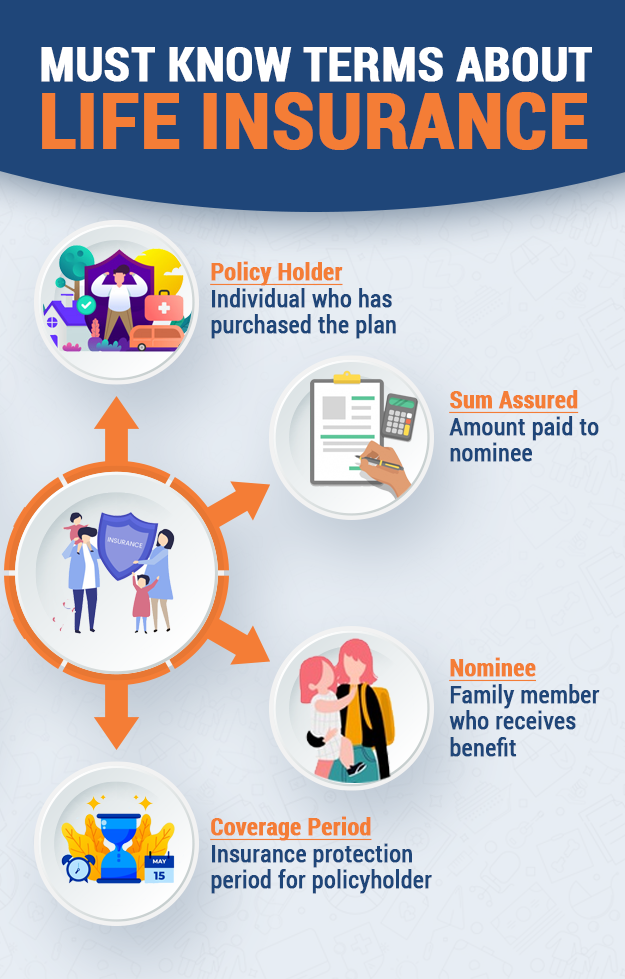

Life Insurance Policy Best Life Insurance Plans In India Max Life Insurance

Life Insurance Policy Best Life Insurance Plans In India Max Life Insurance

Need And Benefits Of Buying Life Insurance Plan By Alankit Insurance Issuu

Need And Benefits Of Buying Life Insurance Plan By Alankit Insurance Issuu

Buying Life Insurance Policy Don T Ignore These 5 Thingsaegon Life Blog Read All About Insurance Investing

Buying Life Insurance Policy Don T Ignore These 5 Thingsaegon Life Blog Read All About Insurance Investing

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.