When entering Street Name enter name only - do not enter Street St Road Rd etc. Special Announcement about office hours and building access Welcome to the Erie County Auditors website where all of the information you need is just a click away.

WELCOME TO THE ERIE COUNTY REAL PROPERTY TAX ONLINE PAYMENT SITE.

Erie county tax bills. Erie County Real Property Tax Services Real EstateReal Estate Details. Erie County has one of the highest median property taxes in the United States and is ranked 145th of the 3143 counties in order of median property taxes. Search Erie County property and tax records.

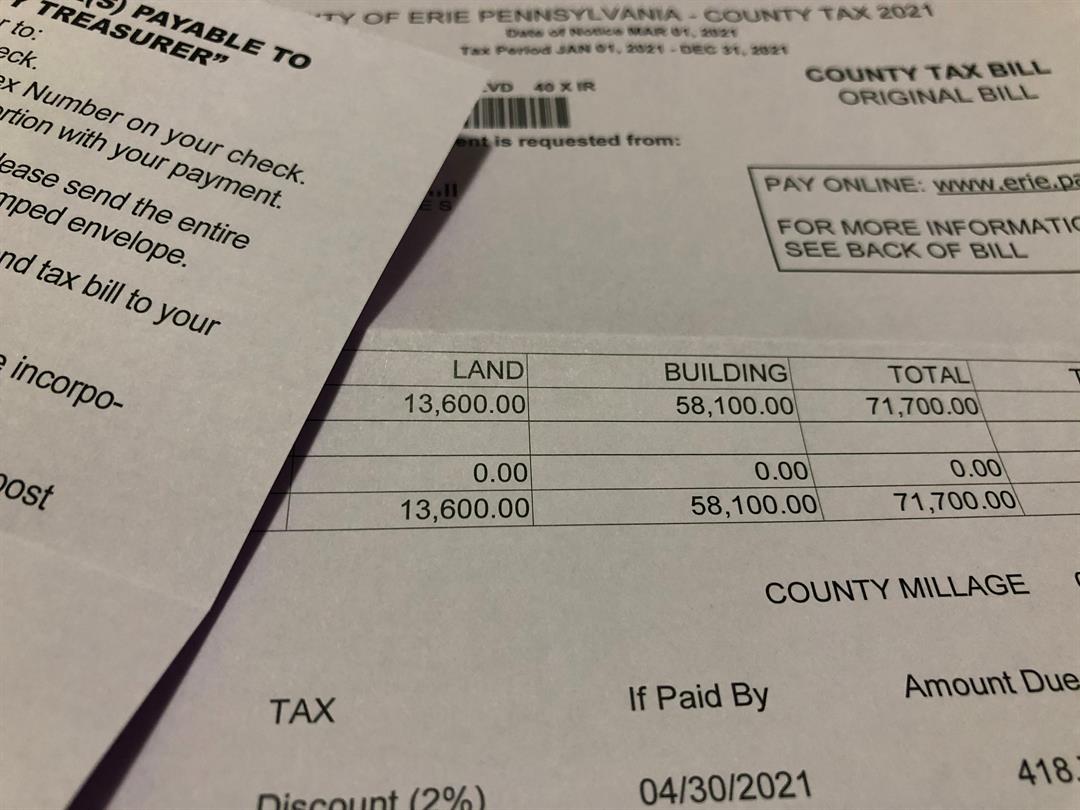

The incorrect tax bills which impacted the countys three cities and first-ring suburbs of more than 10000 people were discovered last week Friday Jan. Erie County municipalities are. Erie County collects on average 265 of a propertys assessed fair market value as property tax.

The Tax Claim and Revenue Office which is one of three divisions in the Erie County Department of Finance has two functions. All fields are not required. Erie Property Tax Payments Annual Erie Erie County.

If you pay your bill on or before the last day of March you receive a 2 discount. Erie County Property Tax Bill Real Estate. Online tax payments for the Town and County bill will not be accepted after July 2nd.

Payment can be made with a Credit or Debit card VISA MASTERCARD DISCOVER AMERICAN EXPRESS or an Electronic Check. Dist District Name Tax Collector Address City State Zip. City tax payments are due and payable on May 31.

Erie Countys Tax Claim and Revenue Office collects all delinquent taxes for Erie County. Contact the Erie County Treasurers Office at 419627-7701 if you have questions about your taxes or tax bill. Erie county property tax records.

Payments made to Erie County for back taxes will not appear on this website. Erie Countys tax levy has risen every year since 2004. The Tax Claim bureau disburses funds to various taxing authorities and conducts various tax sales in.

When searching by Owner Name exclude your middle initial. These represent the 2015-2016 School Bill which was due as of December 31 2016 and the 2016-2017 School Bill which was due as of February 28 2017. For back tax information visit wwwEriegov.

And for school districts in the county. If the taxes. The recent 44 million overbilling on Erie County tax bills has resulted in headaches for town clerks and county staffers apologies from county officials and confusion for taxpayers.

Jan 08 2021 Following are real estate transactions over 5000 as listed in records of the Erie County clerks office for the week ending Sept. Median Property Taxes Mortgage 2406. Partial payments may be made via mail or in the Town Clerks office.

To pay current Erie County Property Taxes. Please be advised that due to the recent change in the billing cycle for the City of Erie School Taxes some properties may list two separate Delinquent 2016 School Bills under Tax Year 2016. Erie County Executive Mark Poloncarz says he immediately ordered the Budget and Real Property Tax Divisions to prepare new tax bills for Erie County residents and.

If you pay after May 31 a 10 penalty is added to your taxes until the end of the year. Welcome to the Town of Cheektowaga Online Tax Payment Search System When searching for your parcel use only one of the search fields above. After authorization of your payment you will be given a confirmation number that you should keep for your records.

Taxpayers who own property within the City of Buffalo can pay their current Erie County Property Taxes on-line. Bill Tax Map Property Address. Erie City Real Estate Taxes are based on a calendar year from January 1 thru December 31 of the current year.

When searching by Property Address enter only the street number and name excluding the suffix Rd. 39 rows Tax Collectors of Erie County. A property tax rate only reflects the dollar amount in taxes charged for every 1000 of a propertys assessed value.

There will be a nominal fee charged for this. Erie County Real Property Tax Services Edward A Rath County Office Building 95 Franklin Street - Room 100. Median Property Taxes No Mortgage 2195.

For the City of Erie and other municipalities. Partial payments can be made through the online tax payment system. Real Property Tax Services - Erie County Real Estate.

The median property tax in Erie County New York is 3120 per year for a home worth the median value of 117700.

Erie County Sends Out Thousands Of Incorrect Property Tax Bills Creating 4 4m Problem Wbfo

Erie County Sends Out Thousands Of Incorrect Property Tax Bills Creating 4 4m Problem Wbfo

Why Your Erie County Tax Bill Is Higher Than You Expected Local News Buffalonews Com

Why Your Erie County Tax Bill Is Higher Than You Expected Local News Buffalonews Com

Why Your County Tax Bill Is Going Up When Erie County Says It S Going Down Local News Buffalonews Com

Why Your County Tax Bill Is Going Up When Erie County Says It S Going Down Local News Buffalonews Com

Comptroller Erie County Residents Were Overcharged 4 4 Million On Property Tax Bills News 4 Buffalo

Comptroller Erie County Residents Were Overcharged 4 4 Million On Property Tax Bills News 4 Buffalo

Erie County Sends Out Thousands Of Incorrect Property Tax Bills Creating 4 4m Problem Wbfo

Erie County Sends Out Thousands Of Incorrect Property Tax Bills Creating 4 4m Problem Wbfo

Http Www2 Erie Gov Ecrpts Sites Www2 Erie Gov Ecrpts Files Uploads Ad 20 20erie2019 20tax 20bills Pdf

Erie County Property Tax Records Erie County Property Taxes Ny

Erie County Property Tax Records Erie County Property Taxes Ny

Erie County Property Tax Records Erie County Property Taxes Ny

Erie County Property Tax Records Erie County Property Taxes Ny

Erie City County Property Tax Bills Mailed Out Erie News Now Wicu And Wsee In Erie Pa

Erie City County Property Tax Bills Mailed Out Erie News Now Wicu And Wsee In Erie Pa

Erie County Calculation Error Will Affect Some Taxpayers

Erie County Calculation Error Will Affect Some Taxpayers

What You Need To Know About Erie County S Property Tax Bill Mess Local News Buffalonews Com

What You Need To Know About Erie County S Property Tax Bill Mess Local News Buffalonews Com

City Treasurer City Of Erie 2020 School Property Taxes Are In The Mail Wjet Wfxp Yourerie Com

City Treasurer City Of Erie 2020 School Property Taxes Are In The Mail Wjet Wfxp Yourerie Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.