Department of the Treasury has started issuing a third round of stimulus payments also known as Economic Impact Payments which will continue over the next several weeks. Choose a dataset to find out how numbers have changed over time see a data preview and download the.

Treasury Offset Program How Top Works

Treasury Offset Program How Top Works

Bureau of the Fiscal Service.

Fiscal treasury gov top. Government-wide Accounting Financial Innovation Transformation Institutions Businesses Individuals Treasury Offset Program TOP For Individual Business Debtors If you are looking for resources for individuals or businesses owing delinquent debts to the US. Contact the Fiscal Service. Have Questions about an Offset.

Fiscaltreasurygov FAQs for the Public FAQs for the Public on COVID-19 TOP automated voice response system 1-800-304-3107 Hearing impaired. Have state income tax state reciprocal program state unemployment insurance UI debts tax withholding and UI overpayment SNAP debts with federal component and child support collections with federal. Dont Wait - Try Searching Today.

Government click the button below to find out more. Financial institutions from participating in the primary market for ruble or non-ruble denominated bonds issued after June 14 2021 by the Central Bank of the Russian Federation the National Wealth. Stimulus check payments will be mailed over the next several.

Pursuant to the EO. Combined Statement of Receipts Outlays and Balances of the United States Government. Depositaries and Financial Agents of the Federal Government 31 CFR 202 Circular 570.

The New Treasury Financial Experience TFX presents the information from the TFM and other Treasury FM guidance in a more organized way according to user needs including. Task-based navigation to more easily find what you need. Respond to workers performing essential.

Of April 15 2021 Treasurys Office of Foreign Assets Control OFAC is issuing a directive that generally prohibits US. Administrative Resource Center ARC- Bureau of the Fiscal Service. Treasurys Approved Listing of Sureties.

Please note that the US. A program of the Bureau of the. Treasurys Approved Listing of Sureties Combined Statement of Receipts Outlays and Balances of the United States Government.

800-877-8339 FAQs for State Agencies FAQs for Federal Agencies. If your ex-spouse is a federal payment recipient the TOP allows the state to offset certain types of federal payments in order to collect the delinquent child support owed. Department of the Treasury.

3201 Pennsy Drive Building E. If you have questions regarding the offset of your federal tax refund or offset of another US. Account numbers start with a letter and are in this format A-123-456-789.

Most People Dont Know That The State Could Be Holding Unclaimed Money In Their Name. Robust search capabilities with relevant related information. Ad We Can Help You Find Unclaimed Money In Your Name.

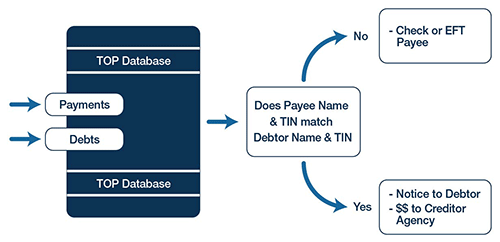

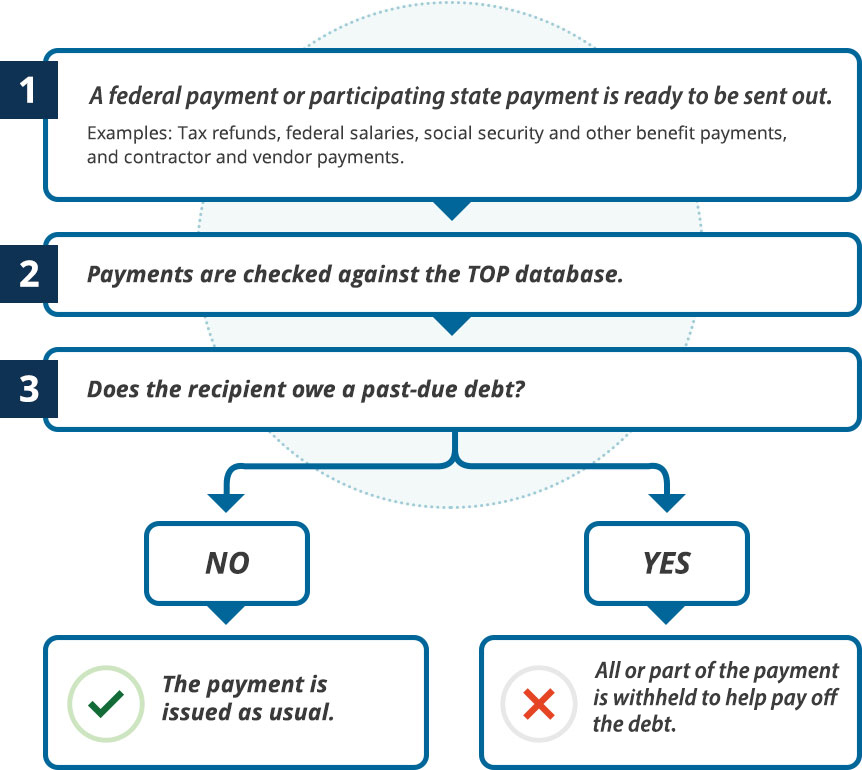

Creditor agencies such as the Department of Education submit delinquent debts to FMS for collection and inclusion in TOP and certify that such debts qualify for collection by offset. In TreasuryDirect you can buy and maintain savings bonds Treasury bills Treasury notes Treasury bonds Treasury Inflation-Protected Securities TIPS and Floating Rate Notes in accounts with the US. Special Inspector General for Pandemic Recovery SIGPR US.

User-centric Financial Guidance for the Digital Age. See how our data helps answer questions about the federal governments interest rates national debt and revenue. Most People Dont Know That The State Could Be Holding Unclaimed Money In Their Name.

This dataset tracks Treasury Offset Program TOP collections and participation. The Treasury Offset Program TOP is a centralized debt collection program developed by the Bureau of Fiscal Service designed to collect past due debts owed to federal agencies and states including overdue child support payments. Government-issued payment you may phone the Treasury Offset Program Call Center at 1-800-304-3107.

Ad We Can Help You Find Unclaimed Money In Your Name. The American Rescue Plan Act provides 350 billion in emergency funding for state local territorial and Tribal governments to respond to the COVID-19 public health emergency or its negative economic impacts including by providing assistance to households small businesses and nonprofits or aid to impacted industries such as tourism travel and hospitality. Treasury Offset Program - Bureau of the Fiscal Service.

Dont Wait - Try Searching Today. Depositaries and Financial Agents of the Federal Government 31 CFR 202 Circular 570. Contact your state or local child-support enforcement office to determine whether federal payments to your ex-spouse can be offset through TOP.

With state programs states and territories can participate in state income tax referrals 41 states and DC. Help for Users Having Problems Accessing TreasuryDirect. Cross-Servicing Debt Collection Current Value of Funds Rate.

Treasury Inspector General for Tax Administration TIGTA Special Inspector General Troubled Asset Relief Program SIGTARP Report Scams Fraud Waste.

90 Million In Wisconsin Child Support Payments Under Review For Possible Over Payment

90 Million In Wisconsin Child Support Payments Under Review For Possible Over Payment

Treasury Offset Program Contact Us

Treasury Offset Program Contact Us

Https Floridarevenue Com Childsupport Documents Pdf Editsforsampleforms Pdf

Treasury Offset Program Faqs For The Public

Useful Links For Covid 19 Information

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.